By Matthew Keefe,

Managing Director

“Do investment bankers add value during an exit process?” Or, in other words, “Are bankers worth their fee?” I am confident that countless first-time sellers have wrestled with this question as they began evaluating an exit. Historically, the answers to these questions were anecdotal. However, a recent whitepaper by Michael McDonald, an Assistance Professor at Fairfield University’s Dolan School of Business [1] attempted (and succeeded) to be the first to take a more scientific approach to determining if and how an investment banker provides value to a client.

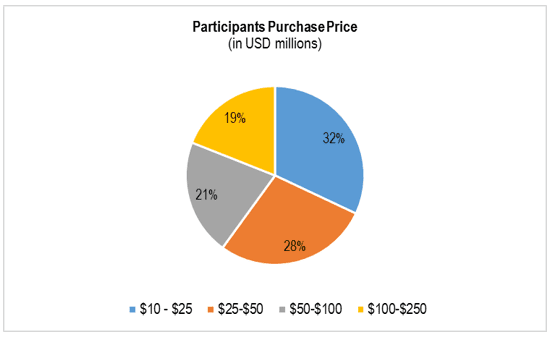

The Fairfield University study represents the first comprehensive independent analysis to determine whether or not sellers valued their advisor, and more importantly, what specific actions and counsel the sellers valued the most. To accomplish this goal, the study used empirical data from 85 business owners who sold their businesses for between $10 and $250 million during the period from 2011 to 2016. All of the sellers used reputable investment banking firms as advisors and the 85 owners accounted for 24 different investment banks. (EdgePoint was one of the investment banking firms that was represented in the study.)

The study’s survey asked the owners a series of questions in an attempt to identify “value”. One set of questions focused on which services the owners valued the most and asked them to rank eight different services (eg, preparing company for sale, identifying and finding the buyer, negotiating the transaction, etc.) The resulting outcome was not a surprise to us at EdgePoint, but I imagine it may be enlightening to owners who have yet to go through the process. The highest ranked service valued by the sellers was, “managing the M&A process and strategy”, closely followed by “structuring the transaction”. Finding the buyer was the lowest ranked service.

The key takeaway is that the M&A process is significantly more complicated and confusing than most first-time sellers realize and an investment banker provides as much value as a guide as he or she does as a broker.

Another interesting finding was that 100% of the respondents said their investment banker added value, albeit in varying degrees. Given three choices (significant, moderate, none), 69% of respondents answered that their bankers added “Significant“ value while 31% answered “Moderate” value. In retrospect, sellers clearly saw the value of having an experienced transaction professional on their team as they structured, negotiated, and ultimately, closed the most impactful transaction of their career.

The Fairfield University study highlighted the valuable role an investment banker provides to a client in an exit process. It also (finally) provides data to help educate and ease the concerns of using an investment banker for first time sellers. With over 250 transactions completed in the past twenty years, the professionals at EdgePoint, are intimately aware of the challenges sellers encounter during an exit process. Our proven track record of successfully closing transactions is grounded in the unbiased guidance and counsel to our clients.

© Copyrighted by EdgePoint. Matt Keefe can be reached at 216-342-5863 or via email at mkeefe@edgepoint.com.

[1] Michael B. McDonald IV. Fairfield University. October 2016.The Value of Middle Market Investment Bankers.

By Russ Warren,

Managing Director

Early on, a senior partner told me, “You know, I never thought much of experience until I got some.”

Part 1 reflected on how emergence of the leveraged buyout, mezzanine financing and the ESOP in the 1970s and 1980s, multiplied transition options for middle-market business owners.

Part 2 reflected on mega-trends influencing business owners, acquirers and transactions as well as memories of The Association for Corporate Growth.

Part 3 concludes with a personal perspective.

Think Grandly of Your Purpose – My life as a merger and acquisition advisor has been 40 years of learning, growing and experiencing afresh. There is no Groundhog Day. It is fulfilling to help a business owner with the most important activity of his or her career: the successful sale or acquisition of a business — that is, the harvest of years, perhaps generations, of creativity and hard work, or the building of a solid platform for future growth.

Taking Care of Business – My first decade in M&A was in a large organization, with staff and support services. That was good, because office technology then was primitive, connectivity as we know it was nonexistent, and daily business activities were far different than today. If you joined the workforce 10 or 15 years ago, it’s hard to imagine the pace of change in daily work routines over the last 40 years.

Since Leonardo da Vinci’s collaborator Luca Pacioli invented accounting in 1494, a pencil (or quill) and sheet of multi-column paper have been used to crunch numbers. I caught the tail end of that era.

Personal computing — using the term loosely — made its appearance in the 1970s. First, came Texas Instruments’ hand-held calculator (which computed present values and other financial necessities), then a Radio Shack TRS 80 (“Trash 80”). Ours housed a Buyer Database, and was the target of a hacker, trying the password “Duran Duran,” (which didn’t work). The laptop’s forerunner, a “luggable” Compaq brand computer, was a drag to haul through airports. Of course, a computer then was an island, not connected to anything else. And, nary a mouse nor an email were in sight. (For more color on computer wiki, read Walter Isaacson’s wonderful book,The Innovators.)

By the 1980s, you could build a spreadsheet using VisiCalc or SuperCalc PC software, and store results on a “floppy disc.” Often, you ran out of disc capacity before finishing, because early floppies held only 80 kilobytes. Later, an improved floppy could store 1.4 megabytes of information.

Before Google, research occurred in a library, and results took days, not an hour or two. Of course, the internet and search engines changed the world in many ways; some profound and obvious, some subtle.

Today, people expect you to do your homework, and they judge you on whether you cared enough to do it. The upside is, with thoughtful use of standard technology like Outlook, you can casually seem to have an awesome memory by asking about family members by name in a phone call with someone you haven’t talked to in years, even if you can’t remember where you parked your car.

Clearly, technology has also changed expectations of appropriate response time. We hear, “I sent you an email an hour ago — didn’t you get it?” Years ago, people had time to think and respond carefully. As psychologist Victor Frankl famously said, “Between stimulus and response, there is a space. In that space is our power to choose our response.” There are times, like during M&A negotiations, when thinking before responding is a definite advantage.

The Bygone Business Lunch – Yes, Virginia, there really was a two-martini lunch, although it was more common with Madison Avenue’s advertising set than on Main Street. Many clients expected a drink at lunch, and expected you to have one, too. The only time I teetered on the edge of inebriation in business, was at the offices of a large London distiller of Scotch whisky. Asked what I wanted to drink, I named their most popular brand. The CFO said in a Highland brogue, “That’s a very good choice.” I’d take a sip, and he’d refill my glass. Fortunately, that was the last meeting of the day.

Life as an Entrepreneur – In 1987, I left the cocoon of a large firm and founded The Trans Action Group, a boutique middle market M&A advisory firm. Thus, I gained a special empathy for anyone who starts a business and meets a payroll. As a friend told me at the outset, “The highs are higher and the lows are lower.”

I learned to treasure loyal friendships. For example, the M&A team at Ernst & Whinney advised Bob Elman, a good friend, on his management buyout of DESA International, and when I left, he was seeking acquisitions. Bob said, “We’ll be your first client,” even before I had formed my legal entity.

Allen Ford, retired Senior Vice President of Standard Oil (Ohio), and Allen Holmes, retired Managing Partner of Jones Day law firm, were friends from our service together on the Case Western Reserve University Board. Allen Ford said he and Holmes were going to rent offices and share a secretary, and asked, “Would you like to join us?” Forget what I just said about the time between stimulus and response. I instantly said “Yes.” Now I had a client and some credibility. Life was great!

DESA was the only name on my first year cash-flow projection to become a client, but other clients came and we cash-flowed positive. Allen Ford did volunteer work on our first transaction, the sale of an ophthalmic equipment business owned by the father of another good friend, Fred Clarke. Allen Holmes gave pro bono legal advice, among other things dictating an indemnity clause so effective it drew admiration from many clients. I was indeed fortunate to have the support of such friends.

The uncertainty of a new enterprise was probably hardest on my wife. She was concerned, committed and supportive, asking daily: “Did you call John Smith back? How was your meeting this afternoon?”

I was on my own with computers — almost. Another good friend, Clint Alston, who ran the Ernst IT consulting practice, sent a young colleague over to help me set up shop, and tutor me in things digital. That’s when I discovered a basic rule of technology: Always go to the youngest person around, when you need help. Recently, the Dean of Case School of Engineering explained why this is so. “You and I are immigrants in the electronic age. Today’s students are natives.”

Each person in a small business shapes the culture. A former colleague, Frank Novak, joined the firm as an owner a year after founding. Over 21 years, we grew The Trans Action Group to seven professionals and closed 75 M&A transactions, 19 of them cross-border. From our offices in The Hanna Building, we also watched the early redevelopment of Playhouse Square and downtown Cleveland.

Time Marches On – In 2007, two key members left the firm (one to buy a business and the other to retire), and I realized I really enjoy recruiting clients and working on engagements, more than the compliance and administrative activities consuming so much of my time. After considering the best path, we chose EdgePoint, a fast-growing boutique M&A advisory firm with the same values and mission: to bring top-quality professional M&A services to owners of middle-market businesses.

I was happy to trade my former CEO duties for those of Managing Director, developing new business and serving clients. I studied for the first time since the CPA exam decades before, and got my securities licenses. Years ago, I waited a month for the CPA exam results by mail. This time, it was a very long minute, staring into a computer screen. Both results were well worth waiting for.

As an M&A professional, it is reassuring that my own M&A transaction was successful, and I continue to enjoy working in an energized small-firm environment.

The “F” Word: Fees – It’s curious. Owners who willingly pay up for a fine piece of equipment may be irrationally fixated on professional fees in an M&A transaction. Fees are earned only when the seller’s transaction closes. For a seller, creating orchestrated competition among motivated buyers generates value far greater than the advisor’s fees. To reinforce the value proposition, we use win-win performance-based fee structures, like an incentive percentage above a pre-agreed value. Value-adding service at each stage and frequent communications create a satisfying client experience.

To illustrate, an owner came to me because his general manager wanted to buy the business. He was willing to sell, but said the offer seemed low. It was. We obtained offers well above what the employee could afford. The outcome was a strategic transaction at twice the original offer, with a key role and phantom stock for the employee. Our transaction fees were not an issue.

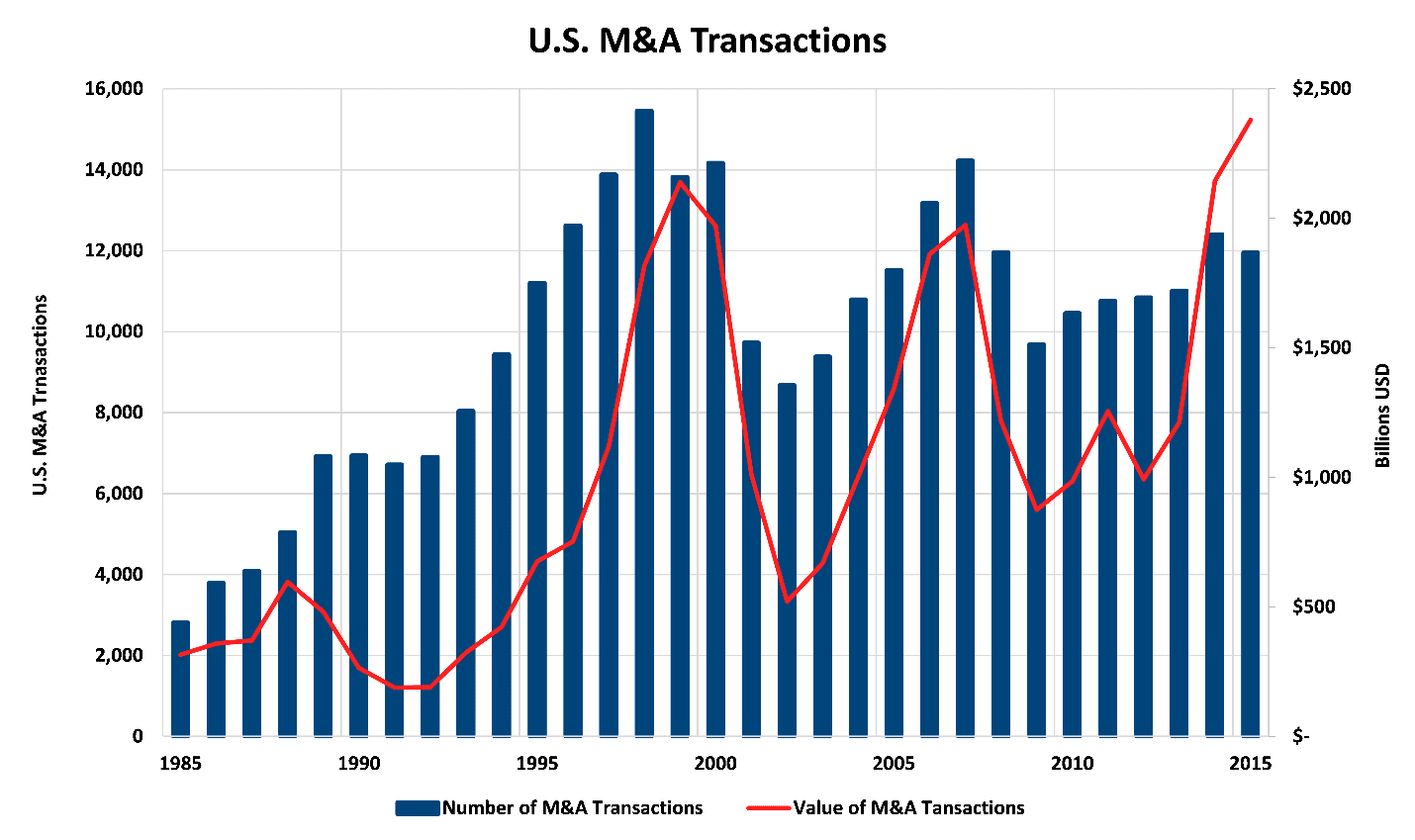

Roller Coaster Ride – As you know, M&A activity rises and falls with economic conditions and financing markets. Over 40 years, it has been quite a ride for owners, acquirers and advisors. The graph below conveys transaction variability since 1985. (Apparently, anything older is prehistoric to the Institute of Mergers, Acquisitions and Alliances, source of this data.)

The smaller-transaction market (think blue bars above) is more stable than mega-deals (dominating the red line) because large transactions are more closely tied to the stock market, and private businesses have strategic and shareholder needs to address, regardless of market conditions. However, many sellers wait too long to pull the trigger. For the owner that misses the “fleeting moment of perfect flavor,” it usually takes at least five years (another growing season) for the fruit to ripen again.

Indelible Clients – While this article is about to degenerate into stories, you also get a “moral” or lesson with each.

Engaged by the Asian Development Bank to improve venture-capital access in five developing economies, we learned there were “Business Development Companies,” which sounded like venture capital firms. Why were they not working? We learned BDCs required collateral, which applicants did not have—so the BDCs made no investments. As it turned out, BDCs were run by former bankers, who continued their old habits. Moral: People can be more important than a business model.

Bob Elman of DESA demonstrated his character a second time. We found a strategic acquisition, and negotiated a Letter of Intentto buy a generator manufacturer. The owner died suddenly before closing. He had told his wife he liked the buyer, so after a respectful time, the deal was on again. Bob said, “I know the business isn’t worth as much without him, but I can’t renegotiate under these circumstances.” We closed on the original terms. That year the hurricane season was intense and DESA sold every generator it had in stock or could manufacture. Moral: Sometimes, doing what feels right can pay.

A client’s president told me during the sale process: “I’m probably the only person in the company that thinks no one else knows what’s going on.” Moral: Confidentiality is very important, but employees seek job security. Working for a company with no visible succession plan is not security.

We sold a Tier 2 automotive-plastic-components manufacturer to a NYSE buyer. The heart of the seller’s operation was a machine with many in-house engineering changes that gave it a competitive edge. The buyer intended to relocate everything to one of its facilities. The seller said, “I really advise you not to move that machine. It has a lot of ‘black art.’” With a seemingly adequate stockpile of parts, the buyer disassembled the machine and shipped it off. They could not make it work right in its new location, and their largest customer ran out of critical parts. Two Morals here: First, buyers should take a seller’s warning seriously. Second, protect your client: the asset purchase agreement had three ways seller could meet earn-out provisions, any one of which required payment—and seller collected, in spite of buyer’s self-inflicted disaster.

What Does M&A’s Future Look Like? – In this three-part article, I’ve tried to convey my take on the Middle Market’s evolution with “thoughtful irreverence.” I hope it’s been illuminating. With no special insight on tomorrow, I eagerly look forward to dealing with interesting new developments certain to arise in our fast-paced business world. I’ll likely need to update this article in a few years—so stay tuned.

© Copyrighted by EdgePoint. Russ Warren can be reached at 216-342-5859 or via email at rwarren@edgepoint.com.

By Russ Warren,

Managing Director

Experience is what happens while you march toward the front of “Class Notes” in the alumni magazine

Part 1 reflected on how emergence of the leveraged buyout, mezzanine financing, and the ESOP in the 1970s and 1980s multiplied transition options for middle-market business owners. (read Part 1<)

The Diversity of Ownership – Over the last 40 years, the makeup and motivation of business owners has changed in ways that will affect middle-market M&A for decades to come.

The age at which owners are ready to sell has fragmented dramatically from the 60 or 65 year old transitioning for retirement years ago. Today’s founder may want to sell at 45 or 50 and do something else with the rest of life – maybe start another business, “give back” in nonprofit activity, or seek “life experiences.” Forget the hammock; bring on helicopter skiing and Habitat for Humanity!

Yet, overall, data shows the average age of business owners is increasing. For some, the phrase “80 is the new 65” resonates. People act younger, live longer, work smarter and feel less constrained by past retirement conventions.

Few women ran or started businesses in the 1970s. Gradually, that has changed. As one measure, top MBA programs now have 35 to 45 percent women in their ranks, and gender creep is expected to continue. A 2015 study by Womenable and American Express found 30 percent of all businesses in America are women-owned, and revenues of women-owned businesses have increased 79 percent since 1997.

Similarly, the number of Minority Business Enterprises (MBEs) owned by African Americans, Hispanics and Asians grew 60, 44, and 40 percent respectively between 2002 and 2008, according to the Minority Business Development Agency, as many public contracts and large corporations encouraged more inclusiveness. Many of these MBEs are growing into middle-market companies and beyond.

Many owners of successful businesses today say their children have no interest in taking an active role in the company, raising the need to transition the business proactively to employees or an unrelated party.

Consolidation Pressure Cooker – During the 1990s, owners of smaller U.S. companies in many sectors began to feel increasing pressure (beyond the tendency of mature industries to consolidate) on profits and their very existence, from four long-term megatrends:

The term “Critical Mass” took on a whole new importance. Owners heard, “Get bigger or get out.”

To remain globally competitive, major multinational corporations formed close working relationships with fewer suppliers. It was just too expensive to buy a few items from a whole lot of suppliers. For example, Rubbermaid sought to reduce its supplier base by 80% to achieve a sustainable 15% cost savings. To be a “keeper,” smaller companies had to deliver consistently flawless products, just in time, and be ISO 9000 certified.

Product life cycles and product-to-market cycles became shorter. Each new technological development tended to require a larger investment, and to require such investment more frequently, just to keep up.

Globalization came to the middle market. In 1994, America entered the age of NAFTA, and freer trade globally. Less restrictive trade barriers presented both challenges and growth opportunities, but required more resources from participating companies.

Also in the 1990s, buyers’ strategic “add-on” acquisition initiatives sought more than mere financial return. This meant operational due diligence was more thorough and took longer, but risks to the careful buyer were lower and value-creating opportunities greater.

For all these reasons, many middle-market businesses turned to acquisition, joint venture, strategic alliance or a sale or merger, depending on their situation. “Strategic” became the transaction de rigueur.

Seeking Growth: In the Shoes of The Buyer – The buyer’s view is very different than the seller’s.

A buyer buys the future. “Past performance may not be indicative of future success.”

Forty years ago, articles in the Harvard Business Review and other respected mastheads bore this bleak theme: With hindsight, most acquisitions — yes, most — fail to create value for the buyer’s shareholders. The parade of such articles continues in the 21st Century without let up. Ouch!

A successful acquisition creates sustainable profit growth. The first place a company should look for growth is within its own business—new customers, new geographies, new versions of its products or services. That’s because the more you understand, the lower the risk of failure. But, the desired growth is not always available organically, or it may be faster and cheaper to acquire.

Caveat emptor. To create incremental value, the buyer must have a well-reasoned strategy, understand the acquisition candidate, buy at the right price and terms, and successfully integrate the acquired business into its operations.

In my experience, a successful acquisition begins with “know thyself” and a close understanding of the candidate’s strategic fit and value drivers. Jim Dunstan, CEO turned business professor at UVA’s Darden School, poses two questions: “Why do our customers buy from us?” and “How do we make money in this business?” It is better to overpay (a little) for the “right” business than to land a “bargain” that does not achieve objectives.

What turns a buyer on? Buyers pay a premium for Clarity, Profitability, Predictability and Growth.

Many strategic buyers use the private-equity pricing model as their starting point, because that’s where competing financial buyers are. (How much can I borrow, plus how much can I invest for a 25% rate of return?). To that value, they may add a bonus for synergy, depending on how important the “target” (notice the military term) is to their plans, and how strong they perceive competition for the deal. A buyer will share some obvious synergy savings (elimination of some administrative costs) if it has to, but will be secretive about any unique “strategic” synergy. In fairness, that is their value-add, not the seller’s.

Many good acquisitions fail after they close. Why? Because they lack a disciplined plan to adhere to assumptions in the valuation model, or because due diligence was incomplete. (Surprise!) If the valuation depends on closing a facility and moving the business into the buyer’s plant in six months, and it takes two years, the buyer will never see the forecasted return on investment.

The Divestiture: When Less Is More – As Harvard’s Michael Porter says, “The essence of strategy is choosing what not to do.” Companies must be good at pruning as well as planting.

Over the years, divestitures have become respectable, and necessary. Years ago, a divestiture might be seen as a past mistake, or that the company was in financial trouble. That is no longer true. In 2013, a Deloitte survey reported, “corporate divestitures are increasingly being driven by companies’ strategies to focus on growth and shed non-core, low-growth assets, and less by financing needs. As the business focus changes, some assets are worth less to their current owners and more to others.”

Each year many middle-market lines of business, divisions, and subsidiaries are divested. Acquirers actively seek these cast-offs, and win-win transactions can be crafted. Sometimes a business is even re-acquired by its founder.

Cross-Border Transactions – Forty years ago, only large companies, it seemed, were multinational. An ambitious growth objective for a middle-market company was to become national. (What’s not to like about a market of 300 million people, all speaking English?) But, as noted earlier, many companies were dragged into international waters by large customers. Others who had sated a niche market in America found that with a little planning, they could sell their products or services overseas to new customers.

An outbound international initiative for a middle-market U.S. company typically begins with an export program, then an outpost in Toronto, and gradually moves into markets with increasing cultural differences and less modernity, such as Kabul. Well, maybe Kuala Lumpur

Globalization also opened middle-market North American companies with a coveted customer base or unique intellectual property to a range of buyers from Europe, Asia and the Middle East. Today, a strong seller can expect to fetch attractive offers from selected overseas buyers.

Middle-Market Glue – Over the last 40 years, The Association for Corporate Growth has played a key role in bringing buyers, financiers and advisors into a middle-market agora. It is the gathering place.

From a small New York clique, ACG reached 500 members in the 1970s, when I joined. Filling an obvious need, the organization has grown to 57 chapters in 11 countries serving more than 14,000 members of the M&A community.

I have fond memories of attending many an InterGrowth, ACG’s global conference held annually at a posh watering hole in a sunny clime, where we rubbed (and bent) elbows with CEOs of fast-growing companies and other members of the business, financial and governmental glitterati. During the 1981 gathering in Boca Raton, Florida, I made an unplanned day trip to New York. That day John Hinckley Jr. tried to assassinate President Reagan in Washington, and suddenly airport security and air traffic control turned upside down. The President survived, and I returned at midnight, missing the cocktail party I was hosting. One year, Michael Milken — the junk bond king and announced keynote speaker — was a no-show, jilting ACG for his own investor-rich “Predators Ball” event. Post script: In 1990, he pled guilty to felony charges for violating securities law, served time and is banned from the securities industry for life.

When I was ACG President (1995), Richard Teerlink, the accountant-biker CEO of Harley Davidson, won the growth award for an amazing turnaround, and an early example of the resurgence in American manufacturing. We also launched a multiyear initiative to expand international chapters, and chose Diane Harris, head of Corporate Development at Bausch & Lomb, as ACG’s first woman president.

In ACG, friendships form; deals spark. My special long-time ACG friends include Bob Coffey (The Coach, Toronto), Alan Gelband (Gelband & Co., New York), Carl Wangman (ACG Global, Chicago) and Tom Smith (deceased).

Speakers at InterGrowth tell great stories. My favorite is this one, told years ago by Jim Balsillie, Co-CEO of Research in Motion (Blackberry). He was seated near Barbara and George Bush at a fancy dinner. Mrs. Bush told him George was addicted to his Blackberry, so Jim confessed that his wife had a rule that he had to leave his on the foyer table when he came home. One night, he snuck it into his pocket, and went upstairs to read his little daughter a bedtime story. The unseen phone buzzed just before his wife came into the room. Their daughter said, “Daddy just farted.” “Now I had a dilemma,” said Jim, “do I confess to the Blackberry or the fart?” With that, President Bush laughed so hard he sprayed red wine all over the tablecloth.

But Wait – There’s More – In the next issue of the EdgePoint Newsletter, Part 3 will conclude with the advisor’s perspective.

(Read: Part 3)

© Copyrighted by EdgePoint. Russ Warren can be reached at 216-342-5859 or via email at rwarren@edgepoint.com.

By Tom Zucker,

President

Cleveland, Ohio; June 2, 2016 – EdgePoint, a boutique investment banking firm located in Beachwood, Ohio, is pleased to announce the addition of Matthew Keefe. Matt joins EdgePoint as Managing Director. In this role, Matt will be responsible for advising the firm’s clients in matters related to mergers, acquisitions, and financing transactions.

Prior to joining EdgePoint, Matt served on the corporate management team of ERICO International, a privately held manufacturer. During his tenure at ERICO, Matt held the roles of Treasurer, Director of M&A, Director of Customer Service, and Director of Commercial Operations. Before joining ERICO, Matt was an investment banker serving in various capacities at KeyBanc Capital Markets, Bruml Capital and Key Corporate Capital.

“We are excited to welcome Matt Keefe to the firm. Matt brings 15 years of investment banking experience and a strong track record in executing middle market leveraged financings, buyouts, and mergers.” said Tom Zucker, President and Founder of EdgePoint.

Matt Keefe earned his BA from Miami University and his MBA from the CWRU’s Weatherhead School of Management.

EdgePoint specializes in advising middle market businesses and owners regarding mergers, acquisitions, management buyouts, and corporate divestitures.

EdgePoint is a registered broker dealer and a member of FINRA.

Contact:

Tom Zucker, President | 216.342-5858 | tzucker@edgepoint.com

Matt Keefe, Managing Director | 216.342.5863 | mkeefe@edgepoint.com

By Russ Warren,

Managing Director

Life sneaks up on you when you’re not looking. It’s called experience.

When you reflect on how it was years ago, it is clear how much the world of middle market M&A has changed – for business owners and advisors. The art of the smaller deal as we know it is quite young.

No one should want to go back to ‘the good old days’.

The Way It Was – In 1976, the market for businesses with revenues between, say, $10 million and $100 million was inefficient and very thin. Such businesses were truly illiquid assets.

Pricing of a profitable, low-growth manufacturing business, for example, was likely to be less than net book value on the balance sheet. Terms usually included a large measure of seller financing as notes or an earn-out.

An owner had the rather stark choice of selling to someone with ‘no money’ and financing the transaction himself, or possibly being acquired by a competitor likely to erase the company’s identity.

Advisors facilitating a sale of a small business then were mostly lawyers, CPAs and business brokers. In the 1970s, several of the Big Eight accounting firms (now Final Four?) began to introduce clients who wanted to buy to clients who wanted to sell, but there was dynamic tension between the Independence principle and entrepreneurial investment banking practices, such as contingent fees and client advocacy.

Private Equity Is Born – In the 1970s, Nick Wallner, PhD, an entrepreneur who acquired a small business using a debt-based technique borrowed from the commercial real estate industry, published a thick soft cover tome with the catchy title How To Do A Leveraged Buyout or Acquisition. The Leveraged Buy Out, or LBO, was born and the world changed. I spoke on LBOs in London in 1980, and the audience was largely barristers and chartered accountants eager to understand the new transaction they had heard about – revamping the right hand side of the balance sheet from mostly equity to mostly debt. The hot topic earned our seminar a mention in The Financial Times.

The underlying theory is that Investment Risk (of the private equity firm) equals Business Risk (the stability of the operating company) plus Financing Risk (debt). The more consistent the operating company’s cash flows, the more debt the investment can handle, and vice versa.

With the low pricing parameters mentioned above and ample assets as collateral, a buyer needed very little equity (maybe 5% of the purchase price) to finance an acquisition. The operating plan after closing was simply to use the company’s cash flows to pay down debt, selling in five years in another LBO.

Soon entrepreneurial buyers began to seek suitable ‘boring’ businesses and, if needed, pass the hat to their friends, deal by deal, to provide the needed equity. Voila! The owner could receive cash at closing and the business remained independent.

Private equity was not a glamorous business in its early days. I remember meeting with the pioneer firm Kohlberg Kravis Roberts & Co. in its mid-town Manhattan offices, which were definitely underwhelming. They had raised a first fund of $31 million in 1977 to fund a number of smallish acquisitions. But soon, KKR left the middle market for loftier transactions, and in 2000 acquired RJR Nabisco, as chronicled in Barbarians at the Gate.

With competition, of course, valuation multiples for suitable businesses began to rise, and private equity firms had to hone a distinctive strategy to find a competitive edge. Many began to differentiate themselves. For example, Wingate partners sought ‘buy and fix’ situations, and other financiers began to work with experienced operating executives having deep operating experience in niche target markets. Riverside opened offices on four continents to help portfolio companies, and add foreign companies to their portfolio. The concept of bringing more to the table than money was born of necessity.

Another result of rising prices was the need to grow the business, organically or by add-on acquisitions, to achieve higher earnings and a possible multiple expansion, to hit target investor returns.

Private equity firms’ interest in diverse targets, and more financing options, meant that other types of businesses, like distribution, transportation and services, saw a wider range of financial suitors.

Recently, with interest rates on fixed income investments at historic lows and stock market multiples sometimes frothy, family offices have added direct acquisitions of private companies to their portfolio mix, to boost overall returns. Usually, they buy and hold a business, making them an attractive alternative in the eyes of many company owners concerned about a ‘quick flip’ by a private equity firm.

A Place For Mezzanine Financing – As richer acquisition multiples became commonplace, the need increased for nuanced financing structures to make acquirers’ financial return models work.

Banks’ willingness to lend senior debt (least costly financing) into a “highly leveraged transaction” (as defined by the Comptroller of the Currency, The Federal Reserve Bank and the FDIC) is limited by concerns of a recession, rising interest rates, a company’s track record and regulatory pressures.

Accordingly, in the 1980s insurance companies, savings and loan associations and eventually limited partnerships formed available pools of risk capital, such as subordinated notes and preferred stock, with characteristics straddling debt and equity. ‘Mezz’, as it is affectionately called, is midway between senior debt and equity in cost and rights.

Mezzanine lenders earn their returns as a combination of cash interest (fixed or floating with a base rate), PIK interest (accrued but not paid until repayment is due) and ownership rights (e.g. attached warrants).

The ESOP Evangelist – Louis Kelso, a visionary economist and merchant banker (Kelso & Company) who thought everyone should own a piece of the action, invented the Employee Stock Ownership Plan, a unique device for selling a company to all or most of its employees. Kelso created the ESOP in 1956 to enable the employees of Peninsula Newspapers, a closely held newspaper chain in the State of Washington, to buy out its retiring owners.

For years, Kelso worked with Senate Finance Committee Chairman Russell Long, to build into the 1974 ERISA legislation generous tax advantages for both the ESOP company and the owner who sold to an ESOP.

Sometimes misused (as in a failing steel company), the ESOP used as intended has created many millionaires on the factory floor and at steel desks. The tax carrot appeals to tax-adverse owners, and drives the use of this technique even today. I knew and presented a series of seminars with the impassioned Louis Kelso. It was a near-religious experience.

But Wait – There’s More – Reflections will continue in the next two issues of the EdgePoint Newsletter.

(Read: Part 2)

***

The Author’s Journey: It can be helpful when reading someone’s perspective to understand his or her professional experience. Here is mine.

With an engineering degree, a fresh MBA and a stint as Private in the U. S. Army (a reality check if there ever was one), I settled in at Ernst (before Young), auditing a rainbow of mostly mid-size companies and learning about businesses and industries from the inside out. In the mid-1970s, I joined the firm’s nascent merger and acquisition practice when the M&A market was robust and we were still figuring out where and how to play. Eventually, I led U. S. Merger and Acquisition Services for 10 years.

It was stimulating and educational, with client engagements from Hollywood, CA (for Sammy Davis Jr.) to Jamestown, NY (selling a Tier 1 supplier to Chrysler and Volvo). There was a lot of international travel. A capstone engagement (and digression) for me was an on-site study of how to improve venture capital access in Indonesia, Thailand, Malaysia, Pakistan and Sri Lanka, conducted for the Asian Development Bank, a large non-governmental organization. Results included funding for three start-up venture capital firms and the passage of recommended legislation by Thailand.

Months later, Ernst & Whinney moved its headquarters to New York, and I founded The TransAction Group, a boutique M&A firm serving middle market businesses. With a former Ernst colleague, we ran and grew the firm. We closed 75 transactions, nineteen of them cross-border. In 2008, we sold to EdgePoint, a dynamic young firm with shared values and the same mission: to bring top quality professional M&A services to owners of smaller businesses. I was happy to trade my former administrative duties for the role of Managing Director, developing business and serving clients.

© Copyrighted by EdgePoint. Russ Warren can be reached at 216-342-5859 or via email at rwarren@edgepoint.com.

By John Herubin, Managing Director

Tom Cruise uttered the famous line, “Show Me the Money!” when portraying a sports agent in the 1996 movie “Jerry Maguire”. His client (played by Cuba Gooding Jr.) was urging Tom’s character to focus on maximizing the cash compensation in his contract. It was clear that “the Money” was the only aspect of his contract negotiations that was important to him.

As investment bankers who have closed 300+ transactions over the last 40 years, we have learned that successful deals are rarely just about “The Money”. All of our clients have unique criteria for a successful sale and it is our job to balance the client’s qualitative factors throughout a sale process.

Two recent experiences highlight this observation.

We represented a business owner that was 50 years old at the time, unmarried, and had a desire to pursue interests outside of the business. He did not need the proceeds to retire comfortably.

We conducted a sale process that produced 20 offers with 6 premium offers relative to his target selling price. After meeting with the premium buyers, one submitted an offer well above the other bidders. Despite the significant potential financial gain, our client was hesitant to accept. He indicated to us that he preferred one of the lower bidders. During the process he came to realize that his key employees had grown to become “like family” and he felt the highest bidder would not be the best steward of the business going forward. With that understanding, we were able to negotiate an acceptable albeit lower value with another bidder that would allow the key employees to be protected post-transaction.

Another engagement involved a second-generation business that did not have a clear successor. The business was the largest employer in the town where they operated. Our clients had significant wealth accumulated from their years of operation.

During our sale process the owners were concerned with maximizing value to further fund a number of charitable organizations they supported. Additionally, the owners desired a buyer that would commit to maintaining the existing facility and employees. Our process proceeded accordingly and resulted in a sale to a buyer who shared the same vision for the business – and community – as the seller. The sellers traded maximum proceeds for the assurance that the business, employees and community would benefit long term.

Much like the Jerry Maguire character, an investment banking partner must explore and understand the core needs and desires of their clients to determine the qualitative factors (i.e. stewardship, legacy, employees, community) that can also influence the quantitative ones (i.e. personal wealth accumulation, retirement planning, generational wealth). When these attributes are identified and properly communicated to buyers, the transaction becomes much more than just, “Show me the money!”

© Copyrighted by EdgePoint. John Herubin can be reached at 216-342-5865 or via email at jherubin@edgepoint.com.

By Paul Chameli,

Managing Director

By design, merger transactions can have significant strategic value to two parties with different yet complementary operating models and philosophies. While these operating and cultural differences can yield a stronger and more complete organization, they can also make for a difficult transaction process—which in turn may put at risk the great strategic potential contemplated by the combination in the first place. This article illustrates this common transactional phenomenon and proposes several techniques to ensure that tension inherent in opposing but complementary business philosophies does not prevent a stronger combined entity.

Consider the following fact pattern:

Company A, a small but growing engineering firm, achieves great success in the industrial sector as it provides the same sophisticated services offered by the largest engineering firms in the world, but with client responsiveness and agility common in smaller firms. This responsiveness and agility, combined with some entrepreneurial risk-taking, contributes to better profitability. At the same time, Company A needs a succession plan, deeper operational resources, and the resources of a large engineering firm to continue to support its growth. Company B is a $1 billion international firm with depth and sophistication of resources to support growth. Overly conservative because of adherence to strict operational processes, Company B is laden by bureaucracy and lack of responsiveness. While possessing deep marketing and other operational resources, the organization is too heavy and sluggish to penetrate the fast-growing industrial sector. Furthermore, layers of oversight and conservative decision-making contribute to limited risk taking—and lower profitability.

Like all successful merger transactions, Company A and B realize they can both benefit from becoming one. The merger gives Company A the scale and international access needed to continue its growth. For Company B, the merger introduces a culture of vibrancy and entrepreneurship that contributes to far greater profitability on its core business. However, in classic “Catch 22” fashion, the same factors that make the transaction such a synergistic fit and success make it more difficult to execute from a transaction perspective. The exact characteristics that each needs in the other turn out to be those that cause trouble during diligence and legal documentation. Company A is concerned that greater recordkeeping and other administrative burdens from integration into Company B will impair the flexibility that makes it successful and profitable; likewise, Company B is concerned that it will be unable to keep up with the more agile and entrepreneurial Company A and is uncomfortable with some of its historical risk profile. And both parties—relying upon their historical culture—are emboldened in their transactional positions, while acknowledging they need the other’s culture to survive and grow in the future.

So how can two very different parties that need each other so much ensure that the fantastic transaction benefits are not lost to cultural differences? While it’s easy to say that both parties need to understand the other’s perspective, seasoned transaction professionals know this is easier said than done, particularly in the heat of transaction negotiation. While there is no foolproof plan to ensure a transaction stays on track in this situation, a few tactics can be employed to prevent the Catch 22 from destroying a potentially perfect combination.

The cultural differences that often come with the greatest strategic fits can be exacerbated by transaction-process functions. When parties can work through cultural differences during this process, the potential for a promising partnership is assured.

© Copyrighted by EdgePoint. Paul Chameli can be reached at 216-342-5854 or via email at pchameli@edgepoint.com.

By Tom Zucker,

President

Rarely am I able to suggest that anyone follow the example of a politician, but these unique creatures show ways that people often handle sensitive communications during an M&A process. During every campaign cycle, we observe numerous candidates perfecting the time-tested techniques of denying and deflecting challenging questions. Although I despise politicians’ verbal maneuvering and lack of transparency, I respect how they achieve their main objective of preventing discussion of a topic that they want to avoid. With this background, below I consider several methods that people use to handle the most sacred truth…my company is for sale!

Deny

“I have no idea where they would have gotten that idea”, “Just rumors”, and “My company is not for sale”, are just a few of the common responses that an owner will use to deny the fact that indeed, their company is for sale. The outright denial is a common technique to refute the rumors. A denial might be appropriate where an owner is legally bound by a Confidentiality Agreement with a buyer (e.g., a publicly traded buyer) not to disclose that a transaction is in process. This approach often does not feel consistent with the character of the owner, but certainly would make a politician proud.

Deflect

Typically, early in a sale process, the business owner will deflect questions and observations. Recently, the V.P. of Marketing for a client of ours approached the business owner with the comment, “I recently heard from a supplier that our company is on the market”. Despite the efforts of a skilled investment banker using code names, Confidentiality Agreements, only contacting senior level executives, and demanding a very tight timeline, occasionally someone in this chain of communication will breach confidentiality regarding the deal. Our client was disappointed in the realization of a breach, but was forced to respond quickly. He confidently responded to the executive, “Everything in life is for sale at the right price.” In this example, the deflection seems to have satisfied the V.P., but there is no certainty that the owner’s answer completely dismissed the V.P.’s lingering concerns (or those of others involved).

Disclose

Many business owners utilize some of the previous approaches in the early stages of the sale process and then eventually disclose the sale prior to Closing. The later in the process that an owner can disclose the fact a sale is likely to occur, the less likely it is that employees, competitors, or other parties not directly involved in the negotiations will influence the outcome. Typically, an owner will notify a few key managers early in the process to provide proper insight and support, and then expand the number of internal people aware of the pending event as buyer interest and offers solidify. The disclosure to customers, other employees and family members is often deferred until just days or weeks prior to the closing of the sale. An owner must resist the desire to share the good news and defer disclosing until they are ready to handle the barrage of inquiries, questions and concerns and the deal has sufficiently solidified. As one would expect, it is often those with less facts and control that will worry the most and often extend their anxiety and uncertainty to others who would be impacted by the sale. It is human nature to fear uncertainty and circumstances beyond one’s control.

In order be prepared for questions about the sale before you have raised the issue, an owner should work with their investment banker to be prepared. Developing a communication plan at the start of an engagement is critical. The owner should have a truthful answer prepared for various inquiries, depending upon who raises the issue (i.e. employees, customers, suppliers). The answer may be slightly different for each or perhaps a consistent answer will be needed- each deal is different. It does not happen often, but being confidently prepared to answer the question of whether a company is for sale can be rehearsed and to properly address the inquiry.

In business, as in life, communication can be everything. During the sale process, this statement is even more evident and true. The intensity of emotions that a business owner has as he or she begins to think about selling “their baby” is very high. The key managers anxiously observe private conversations and unusual requests while thinking to themselves about the security of their job. The advisors (i.e., attorneys, accountants and bankers) strive to protect and advise long-time clients, but they are also motivated to preserve their future business with their client. It is in this environment that a skilled investment banker works, and why deal communications are so critical to a successful transaction. Preparation of a communication plan for this process may not qualify a client to run for political office, but will certainly give them comfort that they are answering with integrity in a manner that does not jeopardize the success of the sale.

© Copyrighted by EdgePoint. Tom Zucker can be reached at 216-342-5858 or via email at tzucker@edgepoint.com.

By Russ Warren, Managing Director and

Tom Zucker, President

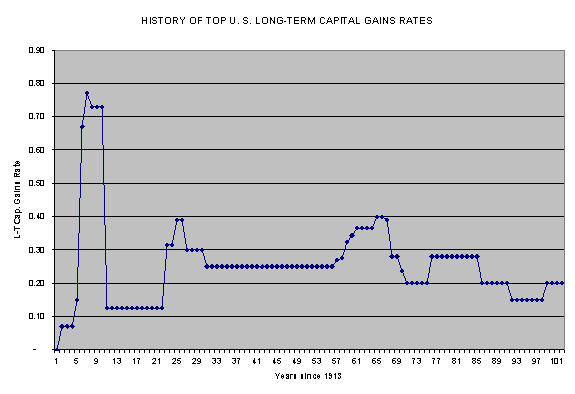

At 15%, today’s maximum long-term capital gains tax rate (LTCG) is the lowest it has been in the last 75 years (see chart below). In 2003, this rate was reduced to 15% from 20%, with a sunset provision, and is effective through 2010.

If Congress and the Administration were to do nothing, the LTCG rate would go back to 20% on January 1, 2011.

However, with bailouts, stimuli packages and new social programs collectively costing trillions to fund somehow, what better place in Washington’s view to raise revenue than from capital gains? There is also historical precedent. As recently as 1996, the LTCG rate was 28%. Throughout the 1970s, the rate was 28% to 40%.

The prospect of paying more to Uncle Sam if you close the sale of all or part of your business after December 31, 2010 is starting to get on owners’ radar screens. The impact on an owner’s wallet is shown by the following hypothetical example.

If a business owner obtains $10 million more in proceeds (that qualify as long-term capital gains) than his or her tax basis, the LTCG tax at 15% would be $1.5 million. However, if the LTCG rate were raised to 30%, the extra $1.5 million tax bite would reduce take-home proceeds from $8.5 million to $7 million, an 18% reduction.

In other words, to realize $8.5 million in ‘take home’ proceeds at a constant pricing multiple, the business would have to generate a significantly higher EBITDA. As shown below, for each 10 percentage point increase in the LTCG rate, a business would need to generate 13% to 15% more in Earnings Before Interest, Taxes, Depreciation and Amortization.

| LTCG Rate | Req’d EBITDA | Assumed Multiple | Req’d Proceeds | Keep Factor | Take Home |

| 15% | 2,000 | 5 | 10,100 | 85% | 8,500 |

| 20% | 2,125 | 5 | 10,625 | 80% | 8,500 |

| 25% | 2,267 | 5 | 11,333 | 75% | 8,500 |

| 30% | 2,429 | 5 | 12,143 | 70% | 8,500 |

| 35% | 2,615 | 5 | 13,077 | 65% | 8,500 |

So Uncle Sam is having a limited-term offer – a 15% capital Gains Tax. But to take advantage of this offer, time is of the essence. The typical sale of a middle market business – to an unrelated party, an ESOP or management – requires six to twelve months (depending on factors often beyond the seller team’s control) from the time a financial advisor like EdgePoint is engaged. So, to close a transaction by December 31, 2010, planning and discussions should begin as soon as possible. In the world of Taxes, ‘almost getting it closed by the deadline’ doesn’t count, and could cost a lot of money.

We would be glad to discuss your situation in complete privacy, and assess the best time to begin, given your company’s recent performance and outlook.

© Copyrighted by EdgePoint. Russ Warren can be reached at 216-342-5859 or via email at rwarren@edgepoint.com. Tom Zucker can be reached at 216-342-5858 or via email at tzucker@edgepoint.com.