: Demand for behavioral health services remains at historic highs, driven by rising mental health awareness, continued social stigma reduction, and an increase in stress-related conditions...

The Commercial and Facility Services sector plays a critical role in the ongoing maintenance, repair, and upkeep of commercial, institutional, and residential properties. This broad category spans several key verticals, including facilities maintenance...

Strategic buyers remain active, capitalizing on reduced competition from financial sponsors and more favorable bidding dynamics. As a result, strategics are pursuing tuck-in acquisitions to broaden ...

The shortage of healthcare professionals, especially nurses and allied health workers, is a primary driver for healthcare staffing firms. As hospitals and health systems struggle ...

As the healthcare sector adapts to evolving market dynamics, mergers and acquisitions are expected to remain robust and strategically driven throughout 2025. ...

Professional Services encompasses specialized service providers in such verticals as business process outsourcing (BPO); collections and recovery; test, inspection & certification (TIC); consulting, engineering & design; education & ...

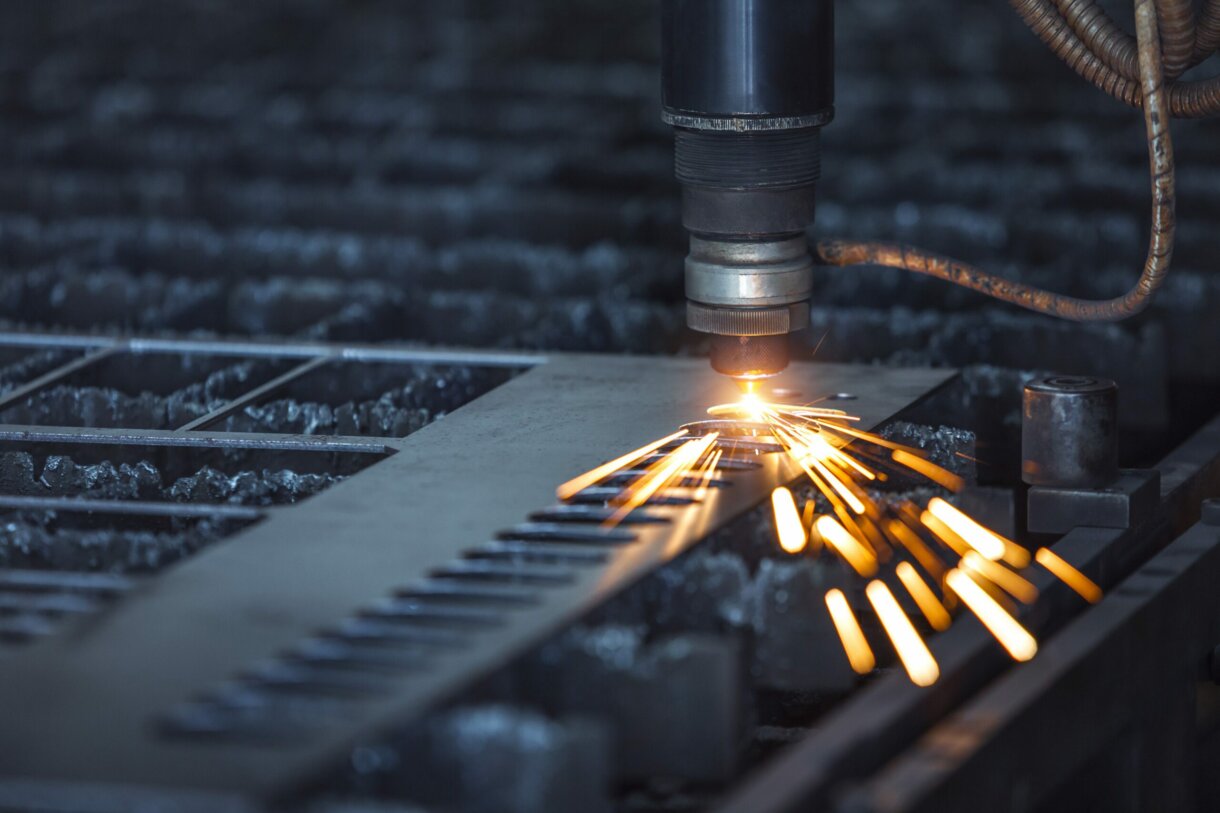

Deal activity in the precision manufacturing sector remains strong, fueled by sustained interest from both strategic buyers and financial sponsors....

Market expansion is being driven by digital transformation across provider networks, payer systems, and patient engagement platforms. Regulatory mandates around data and clinical documentation ...

The Industrial & Infrastructure sector – which includes services such as power and utility, vegetation management, environmental services, waste and wastewater management, equipment rental...

The Industrials M&A landscape in 2024 was marked by resilience across various subsectors, including building products, engineered components, and industrial distribution...