Recast Adjustments-Unlocking Hidden Value

By Paul Chameli,

Managing Director

One of the many advantages of private business ownership is the ability to manage business transactions in a manner that coincides with the owner’s personal interests. Hiring certain family members, paying gifts to workers to thank them for loyalty, making charitable donations from the company, deferring the recognition of revenue, and taking an above market salary are all ways (legal, of course) in which private business owners can use their discretion to manage their business and in many cases reduce their taxable income. Most of these business transactions have the effect of reducing the reported income of the Company, thus minimizing income taxes. When marketing a business for sale, however, a business owner should be motivated to demonstrate the highest earnings possible to potential buyers. To bridge this disconnect, investment bankers will often “recast” a Company’s financial statements to arrive at an income amount more reflective of earnings. Recasting financial statements is the process of demonstrating to a buyer the financial results of the business “as if” it was owned by the buyer, taking into account tax-motivated or other discretionary transactions that reduce corporate earnings. Recasting typically involves the removal of certain expenses recorded on the income statement of the Company that are considered to be discretionary or non-recurring in nature.

This article explains recast adjustments, discusses why and how the presentation of recast adjustments is important to a seller, and addresses some of considerations inherent in the process of recasting financial statements.

What are recast adjustments?

Recast adjustments, also referred to as “add-backs,” “pro forma adjustments,” and “normalization adjustments” are off-statement (not recorded on the internal accounting books) adjustments to the reported earnings of a Company that present the income statement on a basis that would be representative of the business in the hands of a buyer.

Recast adjustments generally fall into one of the following categories:

- Personal expenses that would be non-recurring to a buyer of the business under new ownership, such as owner’s compensation and perquisites (i.e., club dues, cell phones, family travel, hobby expenses)

- Salaries and perquisites for employees, including the owner, that will not work for the Company under new ownership (net any cost for a replacement employee)

- One-time, non-recurring expenses that are not indicative of actual operating results such as expenses associated with an unusual lawsuit, implementation of a company-wide software system, etc.

- The amount of rent expense paid to a sister entity in excess of “fair value” is a common add back – but remember, the real estate owner (typically the seller) must be willing to accept the adjusted rent amount from the buyer in the future.

- Certain investments that could be capitalized - for simplicity, many private business owners record the investment in certain capital items as expenses on their income statement. Office equipment, software, and many repairs that could qualify for capitalization treatment are often expensed by sellers. This treatment has the effect of reducing reported income, which results in lower EBITDA and taxes. It is common to recast these expenditures as fixed assets, which increases EBITDA.

- Charitable donations on behalf of the Company to secure a corporate tax deduction or to act as a good corporate citizen. These discretionary expenditures are unlikely to be continued by a new buyer of the Company and as a result are adjusted from the reported EBITDA.

- Amounts recorded as an expense that could be capitalized, such as repairs and maintenance

- Income or expense that is reported in “other income and expense” but that is recurring and operational (such as scrap sales)

Some not-so-common recast adjustments for private business owners include expense acceleration and revenue deferral, which is used commonly in project-based production environments. Companies that use the percentage of completion method of accounting, for example, estimate profit on projects that are not complete. This undoubtedly can result in the acceleration or deferral of income in any particular period. As a result, investment bankers often retroactively recast the financial statements to properly state the earnings of the Company in the appropriate period.

Creating Value from Recast Adjustments

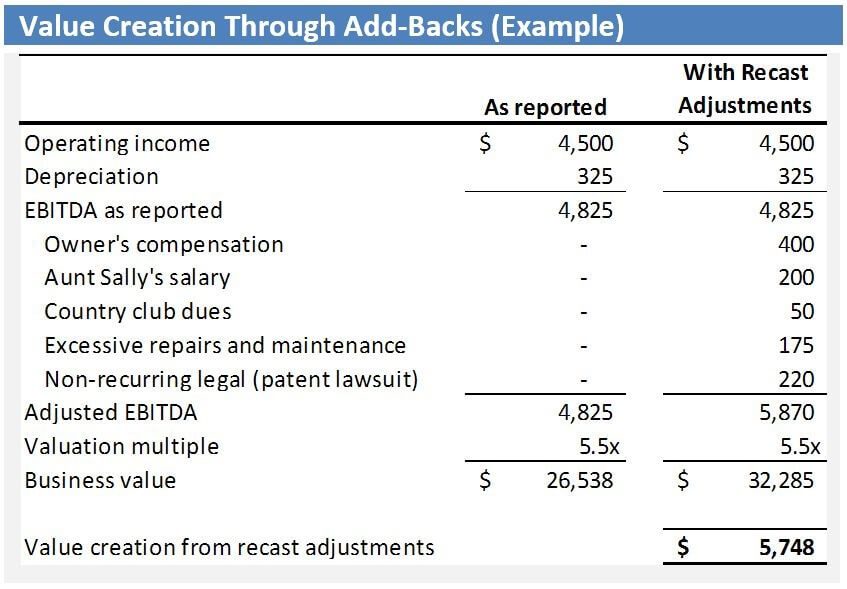

In an era in which the valuation of a business is commonly based upon a multiple of its trailing earnings before interest, taxes, depreciation, and amortization (“EBITDA”), business owners should be motivated to present the highest possible EBITDA when marketing their company for sale. If a buyer is willing to pay the seller 6 times the trailing twelve month (“TTM”) EBITDA for the business, for example, each dollar of EBITDA from a recast adjustment can translate into $6 of incremental value. As a result, presenting and getting valuation credit for recast adjustments represents real value for the Company.

Credibility

While market acceptance of recast adjustments varies from buyer to buyer, the general rule is that buyers typically accept seller recast adjustments that are credible and defendable. A seller should be able to provide ample documentation supporting the expenditure and where it was recorded on the income statement. It is not uncommon for buyers and their due diligence advisors to request verification of journal entries where the expense was recorded. Adjustments that appear to be ordinary and necessary business expenses, in particular, require sufficient supporting documentation to support their non-recurring or discretionary status.

Distinct from Synergy

Recast adjustments should not be confused with synergy. While it is true that a strategic acquirer of your business may find synergy through the elimination of certain redundant functions, those functions do not represent recast adjustments but instead a synergy opportunity. Investment bankers typically identify the synergy opportunity to the buyer, but do not commonly present these savings as recast adjustments.

Considerations

The old adage about “pigs getting fed and hogs getting slaughtered” can apply in the discussion of recast adjustments. There is a fine and very subjective line between legitimate and questionable recast adjustments. There is also a fine line between enhancing value through the inclusion of recast adjustments and presenting them in a way that causes a loss in credibility. Because there is no safe harbor or bright line test to determine accepted and questionable recast adjustments, a merger and acquisition advisor is in the best position to advise you on the market reception for a particular circumstance.

It is important to realize that recast adjustments are a two-way street. While investors will often provide value to a seller to the extent that they agree with the presented adjustments, they will also seek to reduce the reported EBITDA for expenses that are not reflected in the reported earnings of the Company. Buyers look for non-recurring revenue or credits to expenses (such as rebates) in an attempt to determine if the presented EBITDA figures are truly representative of the Company’s earnings. Other factors that buyers consider are whether or not there is ample expense in EBITDA to cover the operational needs to achieve the forecast projections. For example, a buyer may seek to recast the reported income statement to reflect a full year salary for expected hires that will be necessary in the coming year.

Conclusion

A business owner interested in selling the business should consider how value can be increased through the identification and presentation of recast adjustments. A detailed discussion with an investment banker about the fact pattern is the best way to determine opportunities to recast reported financial statements in a way that makes the Company more financially-compelling to the buyer universe. Doing so can literally translate into multiples of value for a seller.

© Copyrighted by EdgePoint. Paul Chameli can be reached at 216-342-5854 or via email at pchameli@edgepoint.com.