Common Financial Deal Breakers and How to Avoid Them

By Paul Chameli,

Managing Director

The strategic fit is well established, there couldn’t be a better complement between the parties. The chemistry amongst the Management team and the buyer is solid and both can envision robust growth together. Customers welcome a combination between the two parties as the merger will create a compelling value proposition. Everything looks great from the perspective of future possibilities as the operational folks talk and explore a combination. But even with this perfect operational fact pattern, the parties are unable to consummate a transaction. What happened?

Often, failed transactions with this fact pattern arise due to a financial disconnect between the parties. While the operational team is very supportive of the transaction, the economics of the transaction must make good business sense to the C-level executives (CEO and CFO). Right, wrong, or indifferent, the earnings of a Target, and the resultant implied valuation, almost always trumps strategic and operational fit. Yes, the qualitative aspects of the business are important and are what creates the interest in the Target; however, it is the financial profile of the Company that determines if a transaction can be consummated.

Disconnect on valuation, misunderstanding about the financial profile of the Target, and / or lack of sophistication in the finance function of the Target are the most common culprits of deal failure amongst middle market private companies. This write-up explores these common deal-killing financial problems and provides suggestions to “to-be” sellers on how to anticipate and cure these defects before they derail the perfect strategic combination.

Valuation Expectations

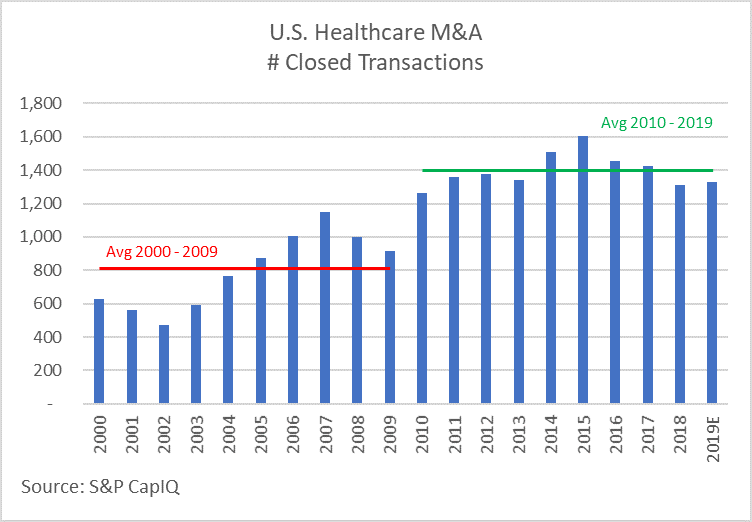

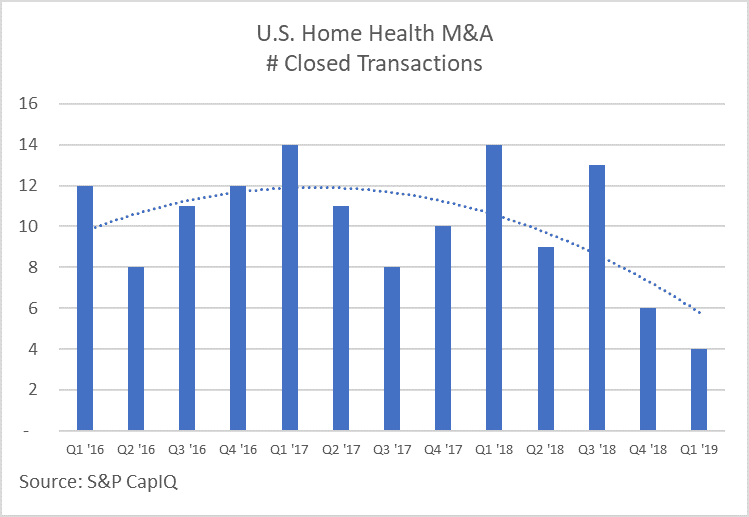

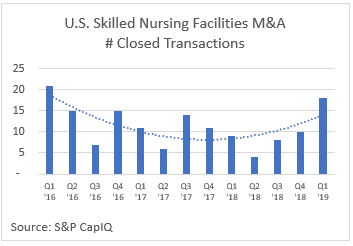

The most common financial deal-breaker encountered in the middle market is a disconnect between buyer and seller on a fair valuation. With robust M&A activity and public markets trading at record levels, it is easy (and rightful) for Sellers to expect high valuations for their business. It can often be the case, however, that the Buyer universe recognizes the same market dynamic and takes a different perspective – that the good fortunes of the Target cannot last forever. And because investors are buying the future, fear of market peaks translate into an obvious disconnect between optimistic sellers and cautious buyers. Furthermore, Seller expectations can be influenced by what they read in the news and hear from their contemporaries about high valuations -perhaps in other industry (such as technology) and assume that these valuation multiples should apply to their Company.

Of the three financial-related deal-breaker issues, this is the easiest fix – the solution is to hire an investment banker. You have heard us say it before, but the best way to ensure alignment and prevent the disconnect is to have an investment banker help evaluate market possibilities to establish expectations – on both sides. From the perspective of the Seller, the investment banker will calculate the implied valuation from Target earnings and provide the details of precedent transactionsin the relevant industryto establish reasonable expectations. At the same time, a good banker will push the market to the highest levels through a competitive process, help a potential buyer understand the Target attributes and market comparable transactions to support higher valuations, and ensure market clearing to give the Seller confidence that they are looking at the most lucrative offers for their Company. Finally, to the extent that the parties still cannot see eye-to-eye on valuation, seasoned bankers can help parties develop creative structures to bridge any valuation gaps.

Financial Profile

The second most common financial pitfall that contributes to a failed sale process is a disconnect between the parties on the financial profile of the Target. While this can arise through a few scenarios, the most common is a presented financial profile that cannot be verified by the Buyer’s accountant. Reported transactions in the Target financials, such as non-recurring income, delay in payment of expenses, deferred capital investment that is necessary to run the company, and overly aggressive forecast that can’t be supported are all also common scenarios that create an expectations gap between Buyer and Seller.

The solution to this fact pattern can be much more complicated than the first disconnect above. In yet another shameless plug – yes, you need an investment banker to help evaluate the financial presentation from the perspective of a buyer. Even with audited or reviewed financial statements, financial transactions and projections should be reviewed thoroughly and perhaps with the help of a CPA that has experience with “quality of earnings” reviews – prior to disclosure to a potential Buyer. This effort will uncover difficult-to-explain accounting treatment, non-recurring earnings, under-accrual of expenses during the interim periods, or just plain errors and ensure that there is no misunderstanding between the parties on the financial profile. Some of the more common accounting issues that we see from private companies that can have create a disconnect between the parties include –

- Inventory valuation – while a CPA may accept that labor and overhead be expensed as incurred for in process inventory, this accounting treatment may create a disconnect between Seller and Buyer on the expectation of future profits (as future periods will have higher profit than the historical periods)

- Non-recurring expenses – compiling adequate support to prove the non-recurrence of these costs and also proving where these amounts hit the income statement is a necessity to ensure that the Buyer universe gives credit to non-recurring costs and / or owner perquisites. Your investment banker will help you accumulate the evidence to demonstrate to the buyer that these costs are truly one-time in nature.

- Accrued expenses – not uncommon for private companies to “expense-as-incurred” or only accrue a series of expenses, such as bonus expense, warranty, commissions, and other similar amounts at the end of a year and, as such, interim periods may appear more profitable to Seller than to Buyer, creating an obvious disconnect. Performing analysis up front to determine if accruals have been made consistently through interim periods will ensure that the Adjusted earnings of the Company are consistent with the manner in which a Buyer will calculate.

- Expensing of Capitalizable items – this goes the other way. Private companies that are motivated to reduce earnings for tax purposes will likely expense as much as possible. The most common example is to expense repairs and maintenance that prolong the useful life of an asset – these amounts could be capitalized and depreciated over the useful life of the asset. When the Seller proposes a pro forma adjustment for this treatment, the Buyer may undoubtedly be skeptical. The best advice is to similarly accumulate the amount of these costs up front and collect the supporting detail so that the buyer universe can see and accept these adjustments early in the process.

Equally important to the accounting transactions is the reliability and detail of the projected financial statements. Because an acquirer is buying the future of the Target, demonstrating that (1) Management knows the drivers of their business and (2) that their projections can be trusted by function of pre-closing verification of the outlook is critical to create the confidence necessary to close the transaction. There are a couple of best practices that a Seller should employ to create that confidence.

- Interim financial projections – the Seller should publish monthly projections for the current fiscal year, demonstrating through the sale process how the Company is tracking to those projections. These projections should be compiled such that Management team can achieve – or beat them slightly – each month of the marketing phase. We recommend that Managers project their results using a “most likely, optimistic scenario” standard, resisting the temptation to under-promise and then significantly over-deliver on the projections. While the Management team is understandably motivated to project low and beat the projections by a significant margin, the Buyer universe does not typically find that type of forecast to be advantageous – it either suggests that Management is too focused on looking good or doesn’t know their business very well. Neither of those attributes are favorable for a transaction.

- Details – providing a detailed model that illustrates (1) revenue segmentation by customer, product line, geography, customer channel, and other meaningful driver of the business; (2) profitability by each of those segments; and (3) the operational factors that contribute to success (i.e., miles driven, production units, sq. ft. produced, etc.) will enable the Buyer to see that the Management team knows the factors that drive the business – and at the same time, also be able to correlate the operational metrics with financial results. And this analysis will also provide the Buyer with the macroeconomic data points for which to build an investment thesis and forecast expectation.

- Macro-economic support – To the extent the Management team can collect or has access to this information, we recommend that a Seller provide the Buyer universe with any industry reports or analysis that supports a positive outlook for the future. But more importantly, the Management team should be ready to explain why their forecast exceeds or underperforms relative to the overall industry growth. If demand for a certain product is projected by analysts to grow 4% per year, Management must be ready to substantiate their 15% growth forecast.

Integrity of the Financial Function

The third most common financial pitfall we encounter in stalled transactions is a lack of sophistication in the financial function of the Company. Many private companies do not invest significantly in deep accounting and financial talent, opting instead (and rightfully so) to invest in development, equipment, or customer support resources. However, when professional investors or large strategic buyers intend to invest millions of dollars into a Target, a lack of financial integrity can be problematic. So what is a level of financial sophistication that will be viewed as adequate to a sophisticated buyer, but at the same time not divert cash from what can actually add value to the organization? While we don’t think middle market private companies need to have a Wall Street-caliber finance department, there are some suggested “must-have” capabilities in your finance function to ensure a smooth transaction.

- Revenue and profit segmentation – at a minimum, we recommend that the Company be able to present its revenue and profitability by product / service, customer, and by delivery channel. Ideally, the ERP or accounting system will track this data on the face of the income statement (or subaccounts) through GL categories for each segment. It is very common that an investor will want to understand concentrations of revenue and profitability, and the absence of this basic information is adequate to raise enough doubt about the transaction and ability for the Target to integrate into the Buyer organization.

- Monthly closes – we recommend that the books of the Target be closed each month, that the results be reportable within two weeks, and that all balance sheet accounts (except Tax accounts) be updated each month. While it is certainly possible to close a transaction without this, sophisticated financial investors and strategic buyers increasingly view this as a necessity to ensure a smooth integration into their organization.

- Business Drivers – we view an understanding by management of the basic operational drivers of the business to be a necessity for sophisticated financial investors. Whether the measurement be the number of units, sq. ft. produced, billable hours, pounds delivered, hours rented, or any other operational metric, it is worth the time and investment to accurately collect and track these operational metrics for review by an investor or buyer. Not only does this information help demonstrate that the Management team understands what contributes to the success of the business, this data will essentially answer most questions on the revenue mix of the business. Furthermore, good operational data, when matched with industry data, can be support for future revenue projections. For example, if the Target’s increase in revenue is linked to new aircraft delivery, the buyer of the Target can use published data on new aircraft deliveries to substantiate the Company’s projections.

While not a comprehensive collection of all financial matters that should be considered to reasonably ensure that a transaction doesn’t derail, the above are helpful guidelines for a Seller to consider as they prepare for interactions with sophisticated financial and strategic buyers.

© Copyrighted by EdgePoint. Paul Chameli can be reached at 216-342-5854, by email at pchameli@edgepoint.com or on the web at www.edgepoint.com