Impact of the Tax Cuts and Jobs Act on…

By EdgePoint

The tax reform signed into law December of 2017 includes lower federal tax rates and several new tax deductions that apply to both C-Corporations pass through entities, including LLCs and S-Corps. Along with those tax deductions come a new set of restrictions on other deductions such as the ability to deduct state and local tax (SALT) against federal income tax, limitations on deducting interest on business loan payments, among other miscellaneous complicated new rules affecting business taxation.

It is difficult to determine what the effect of these new rates, deductions and limitations will be on a business without examining the unique aspects of the individual company, including what business activity it conducts, its asset and wage base, and its ownership since the new rules were targeted to encourage certain types of business activities over others. How this may affect a business owner looking to sell his/her company is further complicated by the lower tax rates on C-Corps that still carry a double tax on the sale of assets, and the promise of lower taxes on pass through entities that seemingly bring the income tax rate closer to the capital gains rate mostly enjoyed on a sale of the business. With all the counterbalancing built into the new tax law, it is important to review some of the key points of the new tax law to determine how this may impact an owner’s decision to sell.

Corporations and pass through entities will all benefit by having lower actual tax rates. C-Corporations rates drop to 21% and the top individual federal rate of 39.6% goes to 37%, with higher thresholds that save an individual over $31,000 on the first million dollars of income without considering any deductions. Additionally, amounts for bonus depreciation are increased significantly, allowing companies to deduct both new and used equipment purchases. Finally, there is a pass-through income deduction of 20% on Qualified Business Income (QBI) under 199A that applies to businesses not in a specified service or trade company. This 199A pass through deduction reduces K-1 business income by up to 20%, but is limited by several factors including how much W-2 wages the company pays and the amount of its gross depreciable assets.

On the limitations side, the SALT deduction is limited to $10,000 and business loan interest is limited to approximately 30% of EBITDA and phases down to approximately 30% of EBIT in 2022, which will lower the ability to deduct interest further. The 199A pass through deduction of 20% on QBI in the highest tax bracket is limited by 50% of W-2 wages or 25% of Wages plus 2.5% of gross depreciable assets. Thus, the deduction benefits lower income companies that may have more wage or asset intensive businesses, and is either non-existent for some service businesses or reduced for eligible businesses that happen to have high margins that make a commensurate high return on assets or labor.

Entity choice will continue to matter to business owners as C-Corps may have a lower effective tax rate than pass through companies, but are still double taxed on the sale of its assets resulting in an approximate 37% effective rate in no-tax states to higher than 45% for mid-taxed states. This is still better than double tax rates as high as a combined 58% before the tax reform. As most of sale transactions are taxed as “asset transactions”, pass-through entities such as S-Corp and LLCs will continue to be the clear tax choice for those owners looking to sell their companies. This is in addition to the fact that pass through entities will create tax basis (AAA) for their owners on the after-tax income that is not distributed, unlike C-Corp owners who do not benefit in that way.

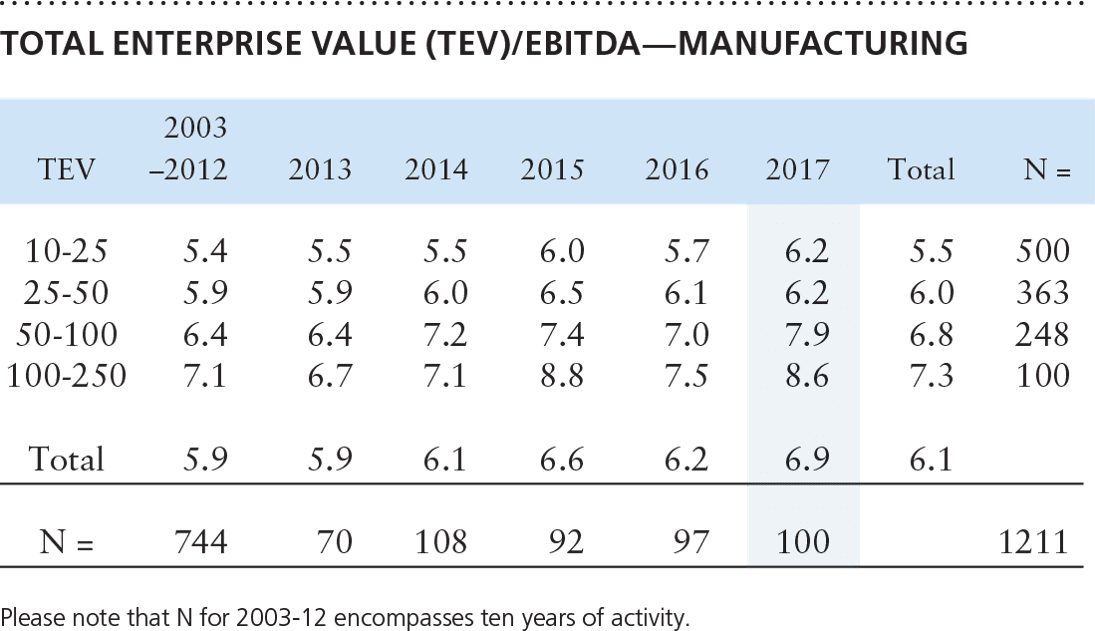

From a tax rate perspective, pass through entities that qualify for the 199A pass-through 20% deduction and are not limited by any of the wage or asset tests will bring their federal rate down from 37% to 29.6% by applying the 20% deduction to their business income. Even so, the loss of the state deduction in the SALT limitation will add close to 2% additional effective taxes on a mid-level tax state resulting in a 31.5% effective comparable rate. Although this is down from the 39.6% top rate prior to the reform, most higher profit businesses will not qualify for the full deduction, and the best-case scenario income tax rate is still significantly higher than the capital gains rate of 20% on the sale of the goodwill of a pass-through entity. Therefore, when you capitalize earnings on a multiple of EBITDA, which is higher than taxable net income – especially when reduced by Capex and working capital reinvestment, owners will find that they simply cannot “work a few more years” and make what they would in the capitalized sale transaction taxed at predominantly capital gains.

The M&A professionals at EdgePoint have been doing transactions through several major legislative tax changes, and although the change at the time may seem to affect a business owner’s decision to sell, it is our experience that taxes are only a part of the decision. In fact, tax changes generally have not played a major role in our clients’ decision to sell, except to the potential accelerating by a few months during a known tax increase period such as the expiration of the Bush tax cuts in 2012.

In our experience, business owners make the decision to sell when they feel they are ready to have the transition/succession discussion, the market cycle is favorable to them, and when their businesses are doing well. The tax cuts in the tax reform act of 2017 should add fuel to an already accelerating economy, and extend the market cycle to allow savvy business owners to take advantage of the current high valuations for their companies, while hopefully getting some tax relief in the process. That, we believe, will be the true impact of the new tax legislation.

© Copyrighted by EdgePoint. Tom Zucker can be reached at 216-342-5858 or at tzucker@edgepoint.com