By John F. Herubin, Managing Director

In most instances, an investor or buyer is purchasing an asset in hopes that it will grow in value during their ownership. This is true for a home, crypto-currency, artwork, or classic car. If growth in value is anticipated to be significant, the buyer/investor is often inclined to pay a premium at purchase for the growth potential.

The same can be said for many buyers of closely-held lower middle market businesses. A well-articulated and visible path for growth can often lead to a premium price being paid to a seller of these businesses. The premium can be material if the buyer believes the growth will significantly increase the ultimate return on investment to their general and limited partners and financing sources.

We often discuss with owners we are advising prior to a sale to articulate for us the areas they see where growth might be achieved. From there we often collaborate and brainstorm about growth paths some owners don’t even consider given their singular focus on operating their business day-to-day. We refine and present these ideas where realistic as pathways for buyers to achieve growth and increase the future value of their investment in our clients.

Growth strategies that often resonate with buyers include:

1. Identifying specific acquisition targets – Many of our clients are aware of a number of smaller or same-size competitors that if acquired would increase both top-line revenue and ideally profitability. These acquisitions may also have some ancillary benefits such as adding a product line, acquiring new or larger key customer relationships, or increase in the seller’s geographic reach. Given the challenges most businesses have attracting and maintaining employees, adding a solid in-place work force from an acquisition can also create future value.

With the possibility of a recession or economic headwinds on the horizon, there will likely be some competitors and owners that will struggle financially during these times, and be more open to an acquisition at a reasonable purchase price in order to keep their business going or facilitate an exit. These circumstances certainly occurred during the 2008-2010 recession. There may also be acquisition targets that have not fully recovered from the Covid pandemic and the resulting obstacles (i.e. labor shortages, supply-chain issues, diminished business).

2. Investing In A New Facility Post-Sale – Oftentimes we advise manufacturing companies that are at capacity in their current facilities, to visualize what growth could ensue from buying an existing or building a new/additional facility. This strategy has been more challenging in recent times given the overheated real estate market. If a strong business case can be made for making the investment that will expand sales and profitability in the future, an astute and well-funded buyer will strongly consider this option when making a buying decision on an acquisition target. This decision will potentially expand a business’s geography to facilitate growth. We’ve seen this strategy work especially well for certain businesses such as those involved in distribution where long-term shipping costs can be prohibitive or stretched supply chains can be shortened and mitigated.

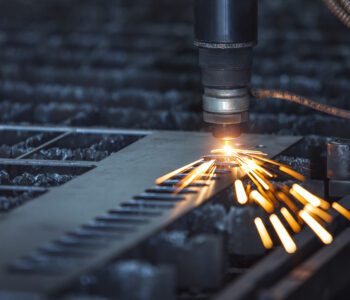

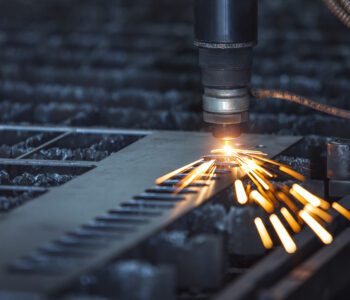

3. Purchasing New Equipment – A conundrum (big word for a guy from Youngstown, Ohio) many business owners confront when contemplating a sale is whether to invest in new machinery or equipment that they believe will help them increase revenue and profitability in advance of a sale. Depending on whether the business owner anticipates remaining active in the business post-sale, they often feel that the new owners will disproportionately benefit long-term from the investment they are making in the short-term. This situation is often analogized to the homeowner deciding whether to refinish a basement or bathroom prior to a sale in hopes that it enhances attractiveness/value and they will recoup their investment. Certain buyers with strategic vision can believe and support growth through this strategy and get creative with the seller for the timing of making this investment. The spectrum of strategies may include:

• outright paying for the equipment investment by the buyer

• some negotiated cost-sharing allocation between buyer and seller with a correlating adjustment in purchase price

• post-sale cost-sharing arrangement based on measurable future growth achieved by the equipment investment

4. International Expansion – Where appropriate it can be beneficial to look overseas to achieve growth. Any of the prior mentioned strategies can be applied to expanding beyond domestic markets. We’ve seen this strategy considered where a company has products that might have an untapped or underutilized exposure or potential demand or customers in other countries. Examples include equipment dealers that have not had the ability to access foreign-based dealers for their equipment. A sophisticated buyer (strategic or financial) can help a seller to implement this strategy with a seller that doesn’t have the resources or knowledge to pursue this path.

5. Acquire/Develop Existing or New Intellectual Property – This strategy is often considered where a business deals with a technically sophisticated process or product (think highly engineered aerospace parts, specialty chemical formulas, unique licensing or processes). We’ve seen sellers contemplate acquiring the engineering department and intellectual property portfolio of a specific company to facilitate growth from these types of assets.

An example where these tactics have been successful will help illustrate. We represented a seller who manufactured a precision metal product used in medical and health care environments. The EBITDA (adjusted profitability metric) for this business was hovering around $3MM. The valuation multiple for this business at this level of profitability was in the 4-6X EBITDA range when we began speaking. The owner was still interested in being involved with the business post-sale and had identified several acquisition targets that would expand their geography and diversify their product line and production capabilities.

Two of those acquisitions resulted in an increase in revenue and profitability and added a product in a previously untapped market. When the private equity owner sold the combined entities several years later, the EBITDA had grown to exceed $10MM. The secondary sale as a result of organic and acquisition growth resulted in an exit multiple of 8-10X EBITDA. Our client benefitted immensely from this exercise that occurred prior to initiating the sale process and was quite lucrative to the buyer and their investors.

Business owners are well-advised to explore and discuss with their investment banking professional before embarking on a sale process, the above and any additional growth areas that if marketed properly, can ultimately result in a greater sale value or desired terms.

© Copyrighted by John Herubin, Managing Director, EdgePoint Capital, merger & acquisition advisors. John can be reached at 216-342-5865 or at jherubin@edgepoint.com.

By Tom Zucker, President

Building a business is one of the most gratifying and challenging journeys for a business owner. The satisfactions of this journey are many including the ability to create opportunities for others, to satisfy customer’s needs, and to build wealth for your family. Certainly, an aspiration of many and accomplishment of a few.

The ability to introspectively recognize the signs that you should sell your business requires great awareness. If the decision was simply based on your physical age, then this process would be rather simple. However, the decision involves many other factors including family desires, clarity on the journey ahead, retirement planning, and many other more subtle issues.

After decades of advising closely held family businesses, we have identified three broad themes signifying that an owner may be ready to transfer control of their business.

“Fear becomes Larger than Greed”

The ability to push, grow, and advance one’s business requires energy, investment, and risk. As owners mature, they often become more complacent and less willing to push for growth. The owner’s satiation with accomplishment or wealth accumulation may underlie this changing mindset.

Signs:

• Important capital investments to support growth initiatives are postponed

• Critical personnel additions are not made which hinders accomplishing new objectives

• Owner begins to focus on external events (“Black Swan”, politics, etc.) more than customer opportunities

“Burden of Leadership becomes Heavier”

Managing a company is a full-time activity that requires great skill and patience. This is not an activity for the faint of heart nor the uncommitted owner. Often as leaders mature, their patience with the minutia of executing a business becomes cumbersome and exhausting.

Signs:

• Owner is having more outbursts or visible signs of displeasure towards leadership team

• The disposition of the owner becomes more annoyed, impatient, and frustrated.

• Owner is increasing his time away from the office and taking vacations to compensate for the mounting frustrations from the business.

“Burning External Desires”

Investing decades into building a business and being focused on a specific industry can become mundane or even boring. To create a diversion from this feeling, many owners seek outlets outside of the business such as charities or non-profit endeavors to give back to their community. Some owners find a second passion through these alternative business activities which can hinder further growing their business.

Signs:

• Entrepreneurial interests of family members become exciting and rekindles some of the lost energy for their original business

• Leadership opportunities in their church or community become more important to them

• Owner begins to realize that time is more valuable than money, and decides to redirect their time towards activities they find more important

These three themes are important signs of an owner becoming ready to sell their business. The common thread between these three concepts is that an owner is more distracted, less focused on growth, and not taking the required risks to advance the business. A famous business consultant once said, “you’re either growing or dying”. Unfortunately, the value of a business favors the vibrant and growing company rather than one in decline and with less focused leadership.

Be aware of the Signs of a Seller. If any of these signs remind you or yourself, begin a dialog with your advisors to begin to chart your course for your next journey. The transfer of leadership or even ownership is one the most challenging responsibilities that an owner must successfully achieve.

© Copyrighted by Tom Zucker, President of EdgePoint Capital, merger & acquisition advisors. Tom can be reached at 216-831-2430 or on the web at www.edgepoint.com.