By Tom Zucker, President

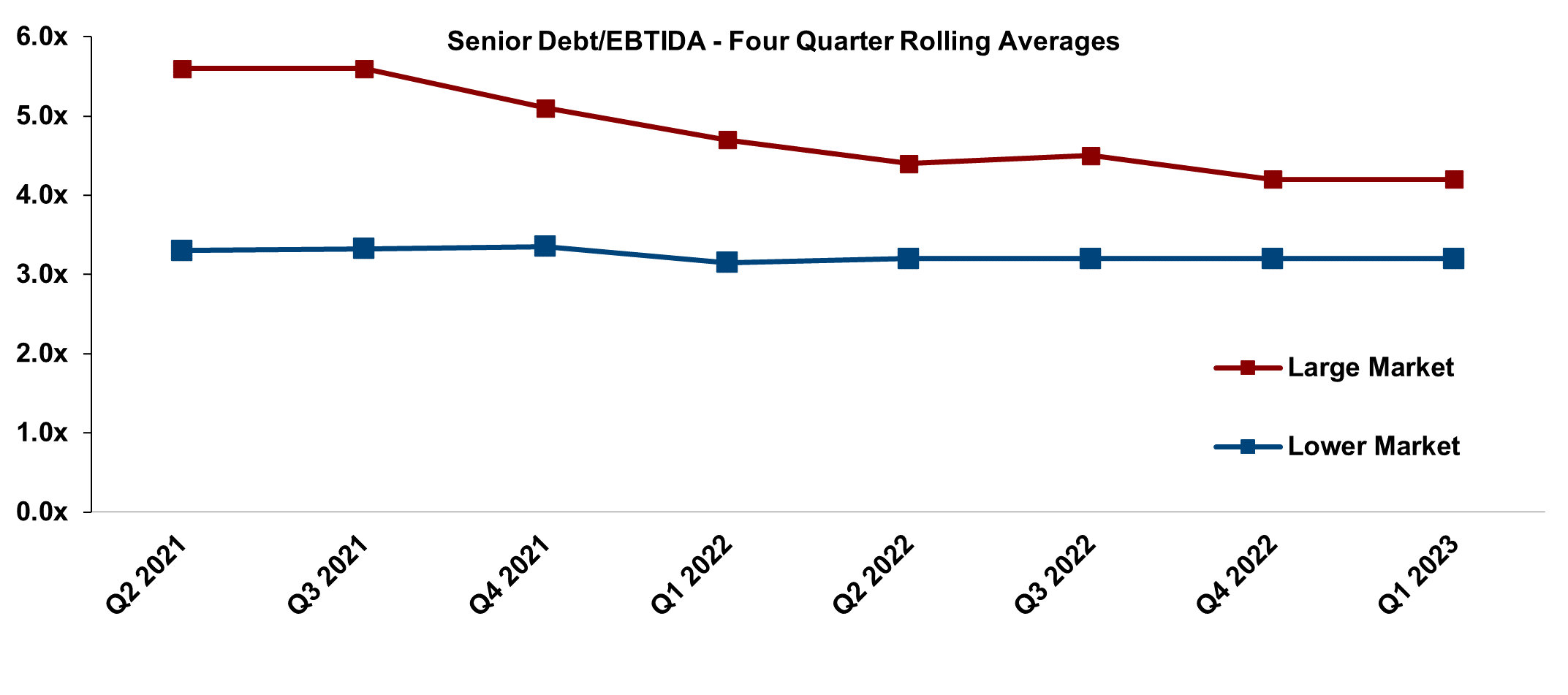

In the high-stakes world of M&A, leverage is a powerful tool that can either make or break a deal. Its impact on large market deals (> $250 million) is unmistakable, driving monumental mergers, while its influence on lower market deals (< $250 million) has historically been more subdued.

Today, lenders are pulling out of large market deals due to interest rate hikes and fears of a recession. On the other hand, lending for lower market deals remains stable and deal activity is robust.

Understanding leverage, its effect on valuation, and the gap between lending in large market and lower market deals can help sellers and advisors properly navigate the M&A market and make informed decisions.

Leverage involves using borrowed capital to amplify potential returns. Large market deals thrive on this concept, as the infusion of substantial funds enables players to execute ambitious projects, undertake defining acquisitions, and embark on high-risk, high reward roll up strategies. In such an environment, leverage acts as a multiplier, turning substantial investments into colossal ones, and fueling exponential growth. As a result, financial institutions (banks and non-banks) and private equity firms eagerly facilitate deals, reaping the rewards of substantial appreciation of these enterprises.

However, the same leverage that propels large market deals to towering heights can also lead to devastating consequences if mismanaged. The 2008 financial crisis serves as a stark reminder of the dangers of excessive leverage. Thus, the high-stakes nature of large market deals demands prudent risk management and stringent monitoring to avoid potential calamities.

Lower market deals operate in a different universe, where the impact of leverage is more muted. These deals typically involve modest leverage and rational growth expectations. For such acquisitions, traditional financing methods and equity-based structures often suffice, and leveraging is less critical for success.

Additionally, lower market deals are oftentimes add-on acquisitions to an existing platform company owned by a private equity firm. As a result, private equity firms will elect to fund these deals through the balance sheets of their platform companies.

The rationale for this leverage gap has many reasons, but the following are the three primary factors:

Risk Assessment: One of the primary reasons banks are more cautious when lending to smaller companies in an M&A transaction is due to risk assessment. Banks and non-banks perceive lending to lower market companies as riskier, with a higher probability of default. To mitigate risk, banks may offer lower leverage rates or demand stricter collateral requirements, sometimes making it challenging for lower market companies to secure the necessary capital.

Lack of Management Depth: Banks assess the management team’s experience and depth before granting loans. Typically, the depth and sophistication of management relative to leveraged finance often impacts a bank’s willingness to extend additional capital.

Regulatory Constraints: Regulatory factors also play a key role in a bank’s lending less to lower market companies in M&A transactions. Courtesy of the Dodd-Frank bill, banks have imposed stricter regulations on financial institutions after the global financial crisis, which has led to more stringent lending standards.

While leverage remains a vital component of M&A, its influence is far from universal. In large deal markets, leverage acts as a double-edged sword, amplifying potential gains and losses alike. The risks and rewards associated with leverage on such a scale demands careful consideration and astute risk management. In periods like today, with higher interest rates and the eminent fear of a recession, the large deal markets have retrenched and lowered transactional leverage rates. This has mollified the volume of M&A activity in the large market.

However, M&A volume, pricing, and activity in the lower market has been less impacted . One of the primary reasons is that leverage has remained stable during the past twelve months. The higher leverage rates and often less accessible non-banks have always been a constraint on market pricing for smaller, privately held companies. However, pricing and deal activity in lower market deals remains robust despite the challenging debt markets.

It is crucial to approach the attention-grabbing headlines in financial publications with a healthy dose of caution. While the large market deals are delayed due to a retrenchment of leverage rates and perceived uncertainties, the lower market deals remain active with modest changes to pricing and leverage rates.

© Copyrighted by Tom Zucker, President of EdgePoint Capital, merger & acquisition advisors. Tom can be reached at 216-342-5858 or on the web at www.edgepoint.com.

By Matt Bodenstedt, Managing Director

Since you’re reading this, chances are you’ve been approached by a prospective buyer, or you’ve heard other physicians brag about the great multiple they received. (Side note: all sellers fib about their multiples.) Selling to a private equity group (PEG) is becoming a popular exit strategy for all types of physician-owned practices. This article answers many of the most frequently asked questions we hear from physicians contemplating their options.

What’s in it for me?

Let’s not skirt around the issue. The most common reason that physicians consider selling their practice to a PEG is to reap a higher financial reward. Many of the alternatives like remaining independent, selling to associates, or selling to a health system don’t offer the best exit plan. Perhaps the thought of chasing money is unsettling, or makes you feel ashamed; after all, you became a doctor to help others. On the other hand, you made great personal sacrifices and invested tremendous amounts of time and money just to become a physician, let alone to build a practice. And there’s no mistaking that modern medicine is a big, challenging business. As a business owner, you’ve borne the risk and deserve an appropriate reward for your investment.

Now that we’ve dispensed with the obvious, let’s not forget there are other benefits to selling one’s practice:

What’s in it for them?

The bad news: their only motivation is making money. The good news: their only motivation is making money. PEGs may have very sophisticated theories, strategies, and tactics that drive their investing; but at the end of the day, they are simply trying to generate a strong return on investment for their partners. Now, compare that to the conflicting interests and political motivations of your typical integrated health system. The key to a successful deal with a PEG is to choose your partner wisely; select a firm whose strategies and principles align well with your own.

How are deals structured?

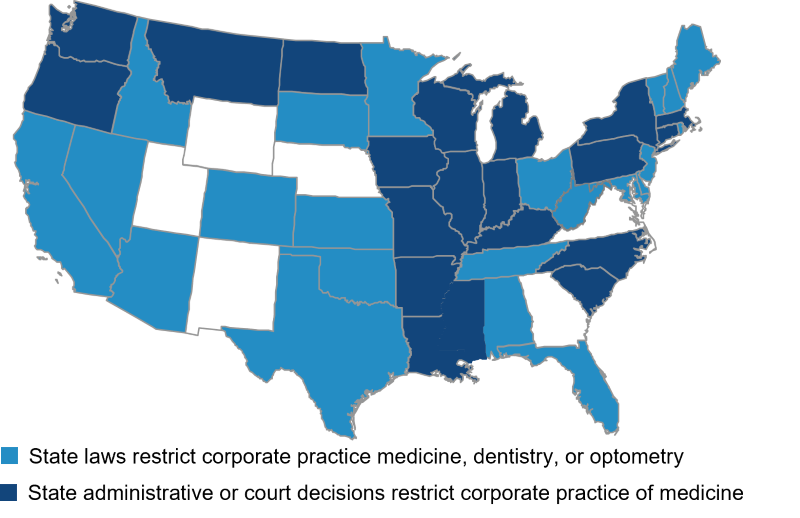

As illustrated by the graphic below, most states have regulations restricting the corporate practice of medicine (i.e., only a physician can own a professional medical corporation). PEGs tend to be full of smart people; so, it should be no surprise they figured out a way to legally work around these restrictions. When this author first started doing these deals in the 1990s, the common term was physician practice management companies, or PPMs. The modern vernacular is management services organization (MSO), or dental services organization (DSO) for dentists.

While individual state regulations may necessitate variations on the theme, the basic model is for a professional corporation (PC) to form an MSO, generally by transferring all non-clinical assets and staff to the MSO. The PC then enters into a long-term management agreement with the MSO for the provision of facilities, non-clinical staff, and other back-office support. The PC continues to employ physicians (and often other clinical personnel) and bill for services. We’re oversimplifying here, but the net effect is that the PC collects the patient revenue, pays the clinical staff, then pays the remainder to the MSO for providing all necessary support services, so that the PC essentially breaks even. The profitability of the practice—after physician compensation—has effectively been transferred to the MSO. Importantly, the MSO is not subject to the corporate practice of medicine restrictions, so this is the entity which can be sold, in whole or in part, to a PEG.

I’ve been told “platforms” get higher multiples; what is a platform?

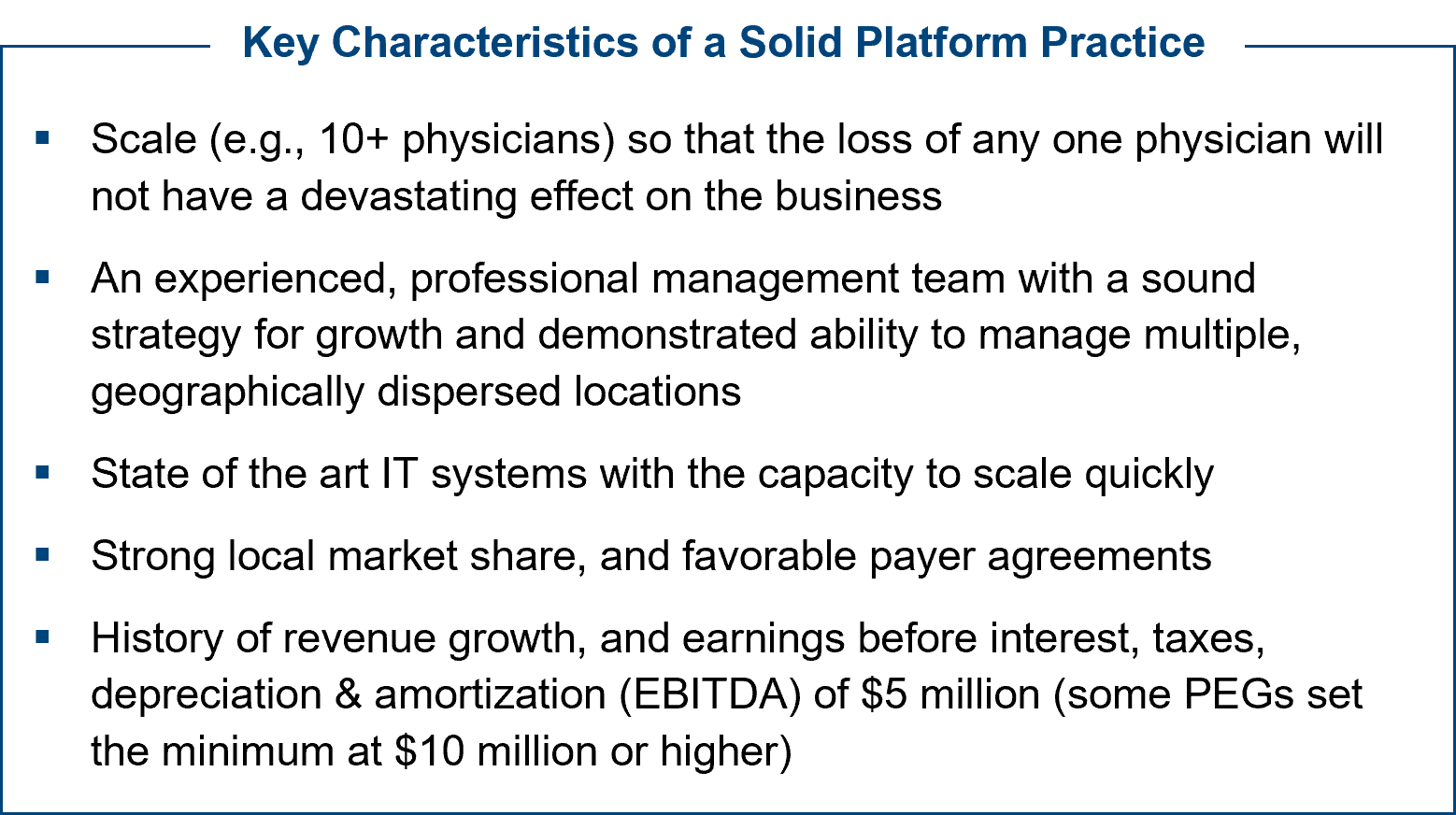

Simply put, a platform is the first investment a PEG makes in a new sector, the foundational practice around which they will build. The platform typically has attributes which make it more valuable than subsequent acquisitions (“add-ons”).

In addition, the owners of the first practice to sell are taking more risk, so they deserve a higher reward. With each subsequent add-on, the risk should lessen; therefore, the multiple being paid should also decline.

Multiple of what?

You’ve likely heard the multiple is applied to EBITDA (earnings before interest, taxes, depreciation and amortization) to estimate the value of a practice; but determining the applicable EBITDA isn’t as straight forward as summing those lines from your income statement. We need to determine pro forma EBITDA, which requires making certain adjustments to recast the income statement as if the transaction had already happened. The key adjustments include:

Physician compensation models can vary widely from practice to practice, and often even differ between owners and employed physicians within a given practice. It’s not uncommon for owner physicians to pay themselves a modest base salary, then rely on distributions of profits for the bulk of their annual income. Other practices deploy a productivity-based model which results in above-market wages for the owners, leaving comparatively little net income for distribution. Pro forma EBITDA replaces the current compensation model with the go-forward model, and recalculates the bottom line accordingly. No doubt it occurs to you that maximizing EBITDA, and therefore the valuation, requires you to minimize your compensation; however, there is a practical minimum. In order for the PEG to accept a proposed compensation model, it needs to be realistic and sustainable. We recommend asking, what would it cost me to hire a physician(s) to replace myself. After all, at some point you will leave the practice and need to be replaced for the business to continue. So what you pay yourself after the deal needs to be sufficient to attract your replacement(s).

EBITDA can also be increased by adding back unnecessary or one-time expenses. Common examples include expensing your auto lease, cell phone, and other items through the business that also have personal uses. Other add-backs can be business-related, for example you expensed an office renovation in one year rather than depreciating it over several years. Conversely, a buyer may layer in additional expenses before valuing the business, such as the incremental cost for insurance if they feel your policy limits are too low. These adjustments can become contentious in a negotiation; so, you’ll want the help of a good investment banker or accountant to help you identify and support adjustments.

What does “rolling over equity” mean?

Multiplying EBITDA by an appropriate multiple, along with the more sophisticated valuation techniques used by PEGs, results in an estimate of total enterprise value, i.e. the value of 100% of the business. That value can then be “paid” to the seller in a variety of ways, with the two primary methods being cash at close and equity in the MSO. By accepting shares in the MSO in lieu of cash, you are said to be “rolling over” your equity.

Let’s look at a simple example. Awesome Medical Practice, which has pro forma EBITDA of $5 million, agrees to an 8x multiple, or a total enterprise value of $40 million. The parties further agree the sellers will roll over 30% equity; therefore, the cash at close (before taxes and transaction expenses) will be $28 million and the sellers will receive equity in the MSO worth $12 million. If Awesome is the first platform acquisition and the PEG pays $28 million of its own money (i.e., all equity, no debt), then the sellers will own 30% of the MSO and the PEG 70%. However, if the PEG borrows $16 million from lenders and only invests $12 million of its own money, the sellers would own 50% of the MSO even though they only “rolled over” 30% of their equity. Conversely, if Awesome was an add-on acquisition of a large existing platform, their 30% roll over equity could be a much smaller percentage of the total outstanding equity.

Why can selling to private equity be more financially rewarding than the alternatives?

Health systems, especially those trying to protect their tax-exempt status, often find it difficult to compete on price when acquiring physician practices. Because they own other practices and services which may benefit from referrals to or from your practice, they have greater exposure to Stark, Anti-Kickback, and other regulations. As such, they need independent third parties to determine fair market value without factoring in those cross-referrals and downstream revenues.

The ever-increasing cost of a medical education means young associates are unlikely to have the financial wherewithal to acquire a practice at anything like its true market value. Additionally, there has been a clear cultural shift over the past 20 to 30 years with more physicians favoring employment over entrepreneurship. The traditional approach of the young associates buying out the retiring partner simply can’t match even a modest valuation multiple.

I plan to work another 10 years; why would I ever sell for 5x?

There are many reasons selling to a PEG might not be right for you; but purely as a financial matter, it’s very often a better option even for those who plan to work another 10 years or more.

The key reasons include:

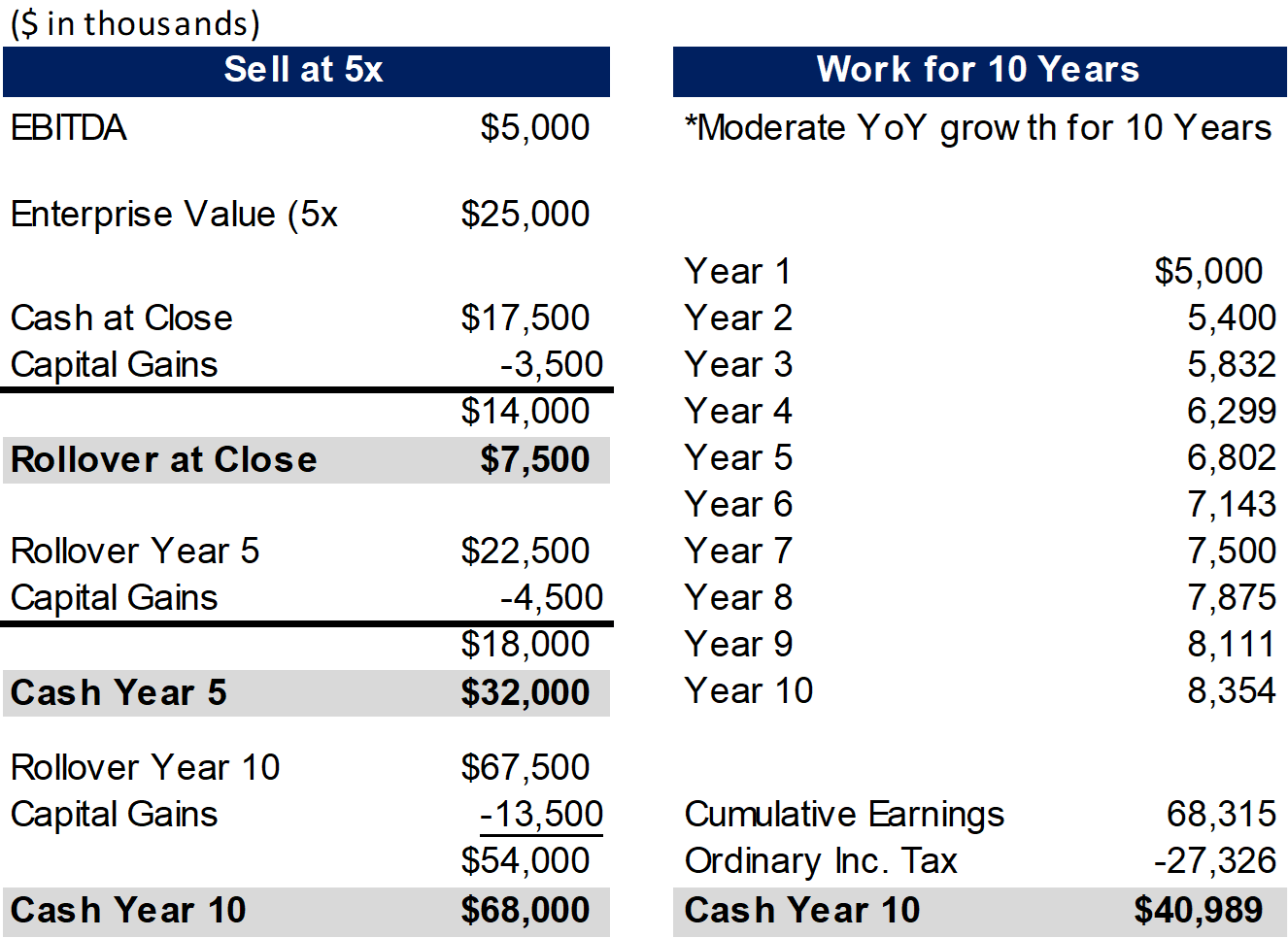

As illustrated below, even working 10 years doesn’t generate as much after-tax cash as selling at 5x because of the different tax rates and the value of the equity rollover. And this doesn’t include the benefit of interest income from reinvesting the cash at close.

So why should I engage an investment bank?

Engaging an investment bank signals to the market that you’re a serious and sophisticated seller. Buyers will know they’ll be in competition and will have to pay more; but they also know you aren’t wasting their time. An investment bank enables you to explore the widest range of options, while keeping your focus on running your practice. After the deal, you’ll have the peace of mind that comes from knowing you got the best deal for the business you worked so hard to develop and grow.

If interested in learning more, please contact our healthcare team: https://edgepoint.com/healthcare/

© Copyrighted by Matt Bodenstedt, Managing Director, EdgePoint Capital, merger & acquisition advisors. Matt can be reached at 216-342-5748 or at mbodenstedt@edgepoint.com