Here Comes the Sun(set) – Preparing for the upcoming sunset of existing Federal estate tax provisions

By John Herubin, Managing Director

The George Harrison Beatles’ song “Here Comes the Sun” can be loosely correlated with the upcoming changes to Federal estate and gift taxes. When the sun rises, we all realize that inevitably, it will also set. A more apt analogy might be the Elton John song, “Don’t Let the Sun Go Down on Me.” Boomer song references aside, this topic will gain more consideration in the upcoming months, especially for founder and family-owned business shareholders.

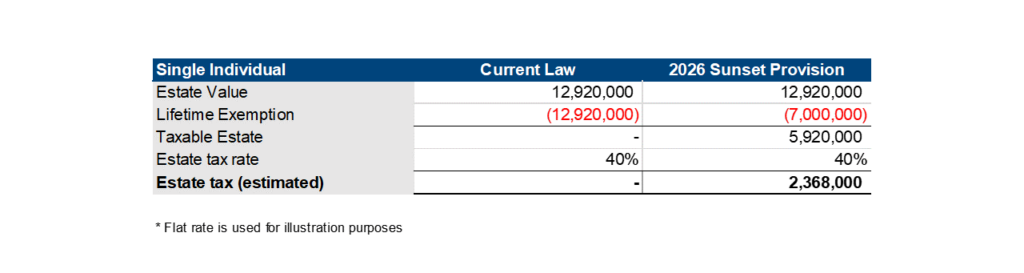

First, a little history. The former sunny reference is to the Tax Cuts and Jobs Act of 2017 (TCJA), which created a tremendous estate planning opportunity for individuals and families. This more than doubled the lifetime estate tax exemption for individuals from $5,600,000 to $12,920,000. For married couples, the exemption moved from $11,800,000 to $24,800,000. Businesses valued within these revised ranges would be exempt from estate taxes upon their owner’s death, when transferred to their heirs.

Now, the sunset. These estate tax exemptions under the TCJA are due to expire or sunset on January 1, 2026. Unless Congress acts before this date, the exemptions will revert to 2017 levels (estate tax rates ranging from 18% - 40%). With inflation adjustments, this amounts to approximately $7,000,000 for individuals and $14,000,000 for married couples. Simply put, the sunset will roughly halve the value of closely held business interests (in addition to other assets) that individuals and families can pass estate tax free to their heirs.

Previously, we have seen elevated discussions around increasing Federal income tax rates prior to a Presidential election year. When Federal capital gain tax rates are rumored to increase, this always seems to spur a corresponding increase in owners looking to sell their business in advance of the potential rate hike. This discussion will likely start heating up again soon, given our current Federal deficit and political climate, yet the same enthusiasm is not usually seen regarding Federal estate and gift tax changes.

Concerning deficits, the Biden administration has been considering accelerating the TCJA sunset provisions for one year to December 31, 2024 (lower exemptions effective 1/1/25). If this occurs, from our standpoint as M&A advisors, there is little more than one year to adjust existing estate plans, and to structure ownership in advance of a sale to implement income and estate tax strategies to meet the owners’ goals and objectives.

For those just getting started, there is a myriad of trust structures that can be utilized to shield value, transition shareholder ownership to the next generation, achieve charitable intent, minimize taxes, and ensure desired asset transfers post-death. These strategies may also impact insurance products created to meet anticipated estate and gift tax liabilities, where applicable. These strategies should be explored with your legal and tax advisors. If a sale is occurring in the foreseeable future (1-3 years), a skilled M&A investment banker should be included as part of the team. When a sale is pursued, it would also be beneficial to keep the estate and gift plan current under all circumstances.

Structuring and implementing a plan to meet potential estate and gift tax implications will take focused time, but we have seen such effort result in millions of estate and gift tax dollars saved and value preserved for future generations. This also can help to resolve many family-related conflicts and confusion, which often occurs in the event of the death of an owner who did not plan this in advance.

It is dangerous to gamble on whether Congress will or will not make these estate tax changes until the end of 2025. If the change happens sooner, lawyers and accountants experienced in this area will become quite busy, which we have seen during previous periods of statutory changes. This will likely limit their availability to help you, as a year will go by quickly!

To conclude with another Boomer song reference, business owners in either 2024 or 2025 who fail to consider impending Federal estate and gift tax changes do not want to be caught humming another Elton John classic, “Goodbye Yellow Brick Road!”

© Copyrighted by John Herubin, Managing Director, EdgePoint Capital, merger & acquisition advisors. John can be reached at 216-342-5865 or on the web at www.edgepoint.com.