The orthopedic sector continues to demonstrate resilience and growth, underscored by contributions from the critical subsector of specialty orthopedic practices and outpatient surgical centers. ...

As we enter a new year, there are signs that we are going to continue the middle-market M&A momentum, which is driven by the historically high levels of uninvested capital that private equity firms and family offices hold....

A seasoned business investor once told me that business owners are either running away or towards something. He clearly stated that he avoids owners running from something and endears himself towards those with a strong purpose towards their ...

The Industrial & Infrastructure sector continues to demonstrate resilience and growth, underscored by contributions from the critical subsector of Testing & Inspection....

Acquisition activity remains steady, supported by a fragmented market and continued interest from sponsors and strategic buyers...

Artificial intelligence has transitioned from a novelty to the frontline of care. Algorithms now handle the bulk of early disease screening, allowing ophthalmologists to focus...

The Commercial and Facility Services sector plays a critical role in the maintenance, repair, and enhancement of commercial, institutional, and residential properties....

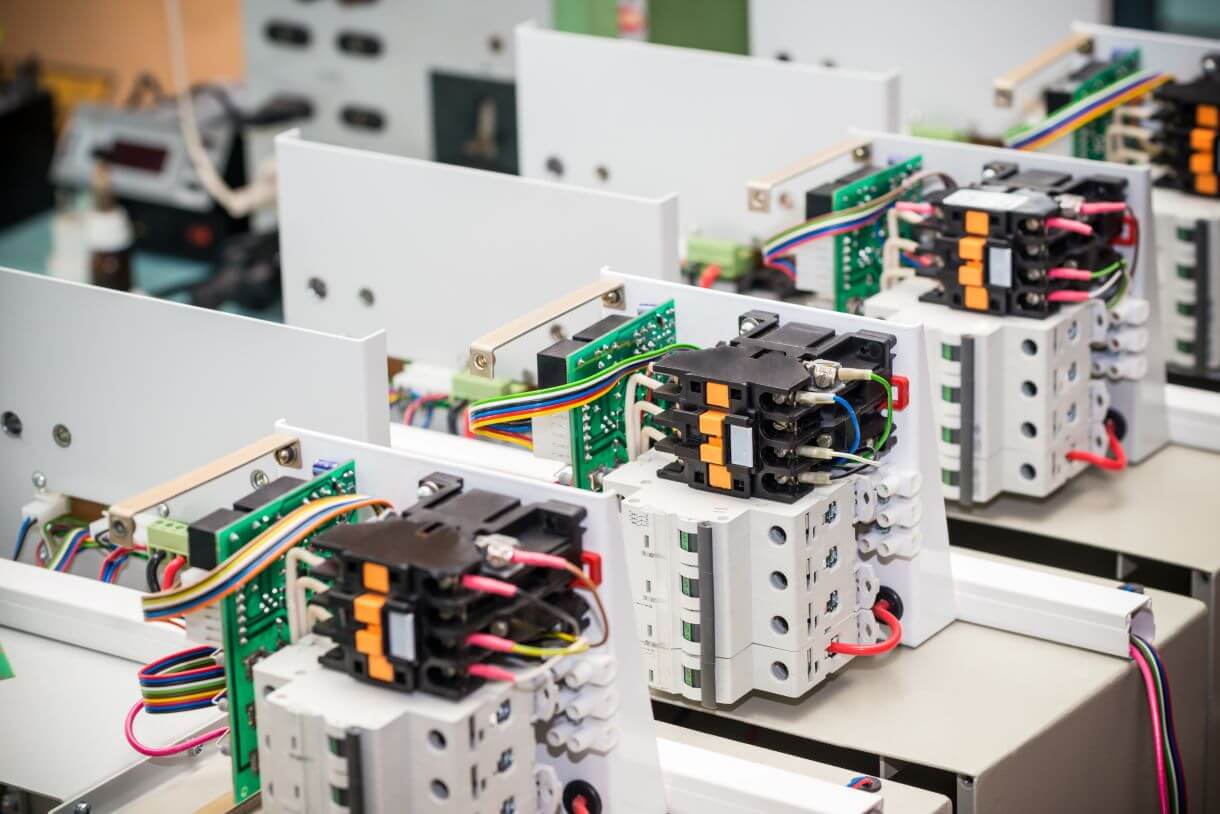

M&A activity in the electrical components sector remains competitive, with deal volume holding steady from 2024. Buyers are prioritizing scaled, differentiated platforms with mission-critical ...

The revenue cycle management (RCM) industry is seeing record levels of consolidation as providers and payers prioritize integrated platforms that combine automation...

EdgePoint Capital Advisors, a leading national independent M&A Advisory firm, is pleased to announce that it has been recognized at the 7th Annual USA M&A Atlas Awards, held on December 9, 2025 at the Metropolitan Club of New York....