Leading with Dry Powder Focused on Middle-Market M&A in 2026

By Bray Ridenour, Managing Director

As we enter a new year, there are signs that we are going to continue the middle-market M&A momentum, which is driven by the historically high levels of uninvested capital that private equity firms and family offices hold. This unprecedented buildup of dry powder is creating a highly favorable backdrop for increased deal activity across the middle market.

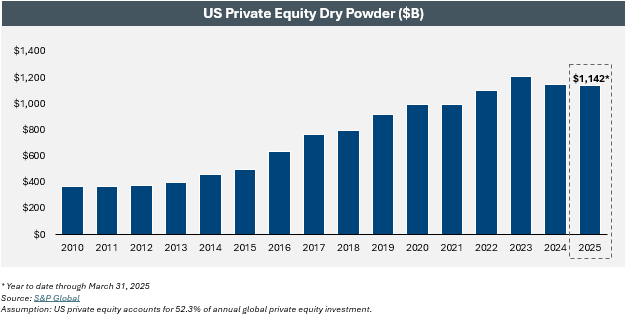

Dry Powder levels

Private equity firms and family offices are sitting on record levels of committed but undeployed capital that has been accumulating over the past four years. As we move into 2026, more than $2.5 trillion in dry powder remains on the sidelines globally (approximately $1.0 trillion in the US), with GPs facing growing pressure from LPs to exit portfolio companies and start deploying capital into new high-quality assets.

Most private equity funds operate within defined investment holding periods of approximately five years, so the capital raised during the 2022-2024 fundraising period is now approaching deadlines for action. In addition, there has been tremendous growth in the number of smaller and emerging family offices, many of which are focused on middle-market opportunities spread across Business Services, Industrials, and Healthcare.

Insight into why capital remained on the sidelines

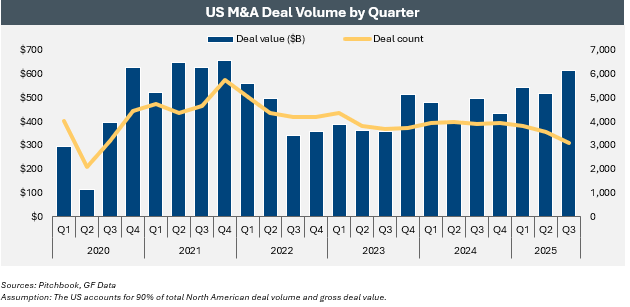

From 2022 through the first half of 2025, challenging market conditions slowed deployment. The increase in interest rates to combat inflation, high financing costs, and compressed returns, while broader economic uncertainty and geopolitical tensions, including supply-chain disruptions, US tariffs deployed across the world, and the unknown of how AI will impact their business or industry, contributed to the uncertainty regarding valuation gaps between buyers and sellers.

During this period, many private equity sponsors adopted a cautious, wait-and-see approach, holding capital in anticipation of more favorable economic conditions. Thus, deal activity declined as many high-quality middle-market companies chose to delay sale processes rather than accept valuations perceived as unfavorable in a risk-averse market and to allow their financial performance to normalize.

Sense of urgency to deploy capital in 2026

As we enter 2026, private equity firms are increasingly motivated to deploy capital, whether through new investments, continuation funds, or exits from existing portfolios to create a new fund. This urgency creates competition for high-quality assets, particularly in the middle market, where numerous sponsors and family offices are targeting a universe of attractive businesses.

As a result, buyers are becoming more active and competitive, offering stronger valuations, incorporating greater flexibility into deal structures, and increasing their accommodation of sellers’ priorities, including post-transaction involvement and legacy considerations.

The premium on quality businesses in the market

The abundance of dry powder has shifted leverage toward owners of high-quality middle-market companies. Buyers are no longer pursuing assets indiscriminately; instead, they are competing for businesses with strong management teams, recurring revenue, defensible market positions, and clear growth potential.

Private equity firms and family offices recognize that successful investments require true partnerships with founders who deeply understand their businesses. Therefore, transaction structures are evolving to include the rollover of equity, continued operational roles for management and employees, and designs to preserve company culture and legacy, marking a departure from the purely financial transactions of prior cycles.

Ways to prepare for these opportunities

For family-founded businesses considering a sale, 2026 presents a compelling window to begin the sell-side process. Selecting an experienced advisor who can guide succession planning, initiate quality-of-earnings analyses, consult with tax and wealth advisors, and provide credible market valuations is critical. Heightened competition does not reduce diligence requirements; rather, it rewards preparedness. EdgePoint Capital Advisors can advise owners along the way about taking proactive steps now in order to be well-positioned to move efficiently, attract strong qualified buyers, and maximize outcomes in competitive sale processes.

© Copyright by Bray Ridenour, Managing Director, EdgePoint Capital, merger & acquisition advisors. All rights reserved. Bray can be reached at 216-342-5855.